Inflation Forecast Charts By Country: What Surprising Trends Reveal

Retail Trader Statistics By Region: Unveiling Surprising Market Trends

Central Bank Balance Sheet Trends And Currency Impact: What To Know

Long-Term Index Charts: Dow Jones, Nasdaq, S&P500 Insights Revealed

Non-Farm Payrolls: Data Impact Study Reveals Surprising Trends

How AI Is Changing Financial Market Data Analysis: Shocking Insights

Historical Oil Price Trends vs. Inflation Rates: Surprising Insights Revealed

Weekly Open Gaps: Powerful Data Insights and Winning Strategies Revealed

Real Interest Rate Differentials And Currency Flow: What Drives Markets?

Analyzing The U.S. Dollar Index: Insights That Will Surprise You

Top Countries By Forex Reserve: Shocking Market Impact Revealed

The Most Traded Currency Pairs: Which Ones Will Dominate Forex?

Forex Liquidity Trends During Global Recession: What You Must Know

Average Daily Pip Movement By Currency Pair: Unlock Trading Secrets

GDP And Its Correlation With Indices Performance: What You Need To...

Forex Volatility Heatmap: How to Use It for Smarter Trading Success

Top Economic Reports That Shock Markets Monthly – What You Must...

Top Economic Reports That Shock Markets Monthly: Unveiled Secrets

Top Economic Reports That Shock Markets Monthly: Secrets Revealed

Top Economic Reports That Shock Markets Monthly: What You Must Know

Analyzing Seasonal Trends In Commodities: Unlock Market Secrets

MetaQuotes Language (MQL): Getting Started Guide To Master Trading

MetaTrader Plugins That Can Improve Your Performance Instantly

Bridging MT4 With TradingView Using Custom Scripts: Ultimate Guide

Using The Tick Chart On MetaTrader Platforms: Unlock Trading Secrets

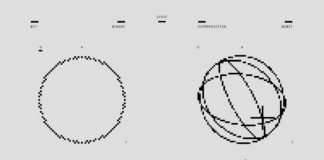

Visualizing Support/Resistance With MT4 Tools: Secrets To Master Trading

Visualizing Support/Resistance With MT4 Tools: Ultimate Guide

Automating Trading With Simple EAs No Coding: Secrets Revealed

Using Scripts For One-Click Trading: Unlock Powerful Profit Secrets

Risk Management Tools Built Into MetaTrader: How They Protect You

Managing Multiple Accounts On MT4 And MT5: Secrets To Mastering Efficiency

MetaTrader Mobile App: Unlock Powerful Features and Expert Tips

How To Use MT5 Strategy Tester Like A Pro: Expert Tips...

Creating A Multi-Timeframe Dashboard In MT4: Ultimate Guide To Mastering Trading

Best Free MT5 Templates For Trend Traders To Boost Profits

Backtesting Strategies With MetaTrader’s Built-In Tools: Ultimate Guide

How To Set Up Alerts And Notifications In MetaTrader Easily

Installing And Optimizing Expert Advisors (EAs): Secrets To Success

MT5 Economic Calendar: How To Master News Trading Like A Pro

How To Create A Custom Indicator In MetaTrader: Ultimate Guide

Best MT4 Indicators for Scalping: Unlock Powerful Trading Secrets

MetaTrader Vs MetaTrader Which One Offers Ultimate Trading Edge?

Parabolic SAR In Trend-Following Strategies: Unlock Powerful Gains

Combining Price Action With Fundamental Events: Secrets to Profit

Combining Price Action With Fundamental Events: Secrets Unveiled

Combining Price Action With Fundamental Events: Secrets Traders Must Know

How To Use Trend Channels For Better Exits: Expert Tips Revealed

The Best Chart Timeframes For Beginners Vs Pros: Ultimate Guide

Gain Authentic Facebook Page Likes in 2026: A Practical Guide to...

Harmonic Patterns And Their Accuracy Rates: Unlock Trading Secrets

The Role Of Time Cycles In Market Turning Points: Secrets Revealed

Technical Analysis For Swing Traders: Best Tools To Boost Profits

Identifying Institutional Price Levels: Unlock Powerful Trading Secrets

ADX Indicator: Unlocking Strength Secrets Beyond Market Direction

How To Scan For Chart Patterns In MT5: Unlock Hidden Trading...

Support Flip Resistance: The Science Behind Market Psychology Explained

Building Confidence In Breakout Trading: Proven Tips To Succeed

Candlestick Analysis In Range-Bound Markets: Secrets To Mastering Trends

COT Reports And Technical Levels: Unlock Powerful Trading Insights

Hidden Support And Resistance Levels Using Price Memory: Unlock Secrets

Bollinger Bands + RSI Combo Strategy: Unlock Powerful Trading Secrets

How To Backtest A Technical Setup In MetaTrader Like A Pro

Top Reversal Patterns And Their Win Rates: Secrets Traders Need

Top Reversal Patterns And Their Win Rates: Secrets To Trading Success

Best Times of Day to Trade Specific Currency Pairs Revealed!

Using The Dollar Index In Currency Trading: Secrets To Success

Major Vs Minor Pairs: Key Differences And Volatility Explained

Currency Wars: Definition, History, and Modern Examples Explored

How Carry Trade Impacts Currency Pairs: Unveiling Market Secrets

Identifying Reversal Patterns In EUR/GBP: Secrets Traders Must Know

How To Build A Forex Portfolio Based On Correlated Pairs Effectively

How To Build A Forex Portfolio Based On Correlated Pairs That...

The Most Volatile Currency Pairs: Secrets To Trading Them Profitably

The Most Volatile Currency Pairs: How To Master Trading Risks

Trading GBP/USD Around Brexit News: Secrets To Master Volatility

USD/CAD Analysis: How Oil Prices Power The Loonie’s Movement

JPY Pairs: Are They A Safe Haven Or A Risk Aversion...

How Central Bank Announcements Affect Currency Pairs: Shocking Insights

The Role of Interest Rates in Currency Valuation: Why It Matters

Exotic Currency Pairs: Unlock Hidden Opportunities and Avoid Pitfalls

EUR/USD Trends and Projections: Must-Know Trade Setups Revealed

EUR/USD Trends and Projections: Powerful Trade Setups Revealed

EUR/USD Trends Uncovered: Expert Projections and Trade Setups

Weekend Gaps And Commodity Market Reactions: Surprising Insights Revealed

Trading Commodities Using Options: Expert Tips To Maximize Profits

How To Build A Balanced Portfolio With Commodities For Success

The Best Commodity Markets for Beginner Traders: Unlock Success

Inflation Vs. Commodities: Unveiling Powerful Historical Correlations

Why Commodity Trading Is Popular In Emerging Markets: Secrets Revealed

The Relevance Of Crude Oil Inventories: Unlock Market Timing Secrets

Supply Chain Shocks And Commodity Price Surges: What You Must Know

How AI Is Being Used To Predict Commodity Price Movements Effectively

Investing In Commodity-Heavy Economies: Unveiling Risks & Rewards

How to Use the S&P GSCI Index for Powerful Trend Signals

The Relationship Between The Dollar And Commodity Prices: Surprising Insights

How Global Demand Drives Iron Ore And Steel Prices: Surprising Insights

Understanding Contango And Backwardation In Commodities: Secrets Revealed

Investing In Water As A Commodity: Unlocking Hidden Potential?

Coffee, Sugar, And Cocoa: Soft Commodities to Watch for Profits

Top Commodities Traded By Retail Vs Institutional Traders Revealed

Impact Of Sanctions On Commodity Prices And Trade: What You Need...

Gasoline Futures: Unlock Expert Trading Tips for Maximum Gains

The Role Of The Bloomberg Commodity Index: Why It Matters Today

Trading Commodity News: Best Platforms and Sources You Need Today

Historical Trends In Oil Prices: What They Reveal About Tomorrow

Are Commodities a Hedge Against Tech Market Crashes? Discover Now!

Precious Metals: Which Shines Brightest Gold, Silver, Platinum, Palladium?

Navigating Commodity CFDs: Key Pros and Cons You Must Know

Navigating Commodity CFDs: Discover The Hidden Pros And Cons

Energy Index Trends: Unlock How to Capitalize on Renewables Boom

Why Lithium And Cobalt Are The New Oil: Unveiling The Power...

Index Investing: What You Need to Know for Smart Wealth Growth

Commodity Supercycle: Hype Or Reality? Unveiling The Truth

How Weather Affects Commodity Markets: Secrets To Predict Trends

Is Copper the New Gold? Discover Why Industrial Metals Soar

How To Trade Commodities In High-Volatility Markets Successfully

How To Trade Commodities In High-Volatility Markets With Confidence

Agricultural Commodities: Unveiling Wheat And Corn Market Trends

Geopolitical Conflicts And Their Effect On Commodity Prices Revealed

Understanding The CRB Index: Why It Matters In Market Trends

Forex and Finance News Site

Forex News

The global financial markets are constantly evolving, and staying updated with the latest news and trends is crucial for anyone involved in trading or investment. The Forex (foreign exchange) market, in particular, is one of the largest and most dynamic financial markets in the world, with trillions of dollars exchanged daily. Alongside the Forex market, the broader financial markets, including stocks, commodities, and bonds, offer numerous opportunities and risks. To make well-informed decisions, traders, investors, and financial professionals need real-time access to reliable and accurate information. This is where Forex and finance news websites come into play. In this article, we explore the significance of these platforms, their impact on trading decisions, and how they shape the global financial landscape.

The Role of Forex News Websites in Currency Trading

Understanding Forex Market Dynamics

Forex trading involves the exchange of one currency for another, making it the largest and most liquid financial market globally. The Forex market operates 24 hours a day, five days a week, and is influenced by various factors, including economic data, interest rates, political stability, and market sentiment. For traders, understanding these factors and their potential impact on currency prices is essential to successful trading.

Forex news websites serve as the primary source of real-time information for currency traders. These sites provide breaking news, live price feeds, expert analysis, and detailed market reports that help traders stay informed and make informed decisions. Popular platforms like Forex Factory, FXStreet, and DailyFX offer essential tools such as economic calendars, market forecasts, and trading signals, which are indispensable for any Forex trader.

Key Features of Leading Forex News Websites

- Real-Time Market Updates: Forex markets are highly volatile, and currency prices can change within minutes. Forex news sites offer up-to-the-minute updates on market movements, allowing traders to react quickly to price fluctuations.

- Expert Analysis and Insights: In addition to news, many Forex platforms feature analysis from experienced traders and analysts. This provides valuable insights into market trends, technical setups, and potential trade opportunities.

- Economic Calendar: A key feature of many Forex news sites is the economic calendar, which highlights upcoming events such as interest rate announcements, GDP releases, and other economic data that can move the market.

- Market Sentiment Tools: Understanding the prevailing market sentiment can be the key to successful trading. Many Forex websites offer sentiment indicators that show whether the majority of traders are bullish or bearish on a particular currency pair.

How Finance News Sites Impact Investment Strategies

Broader Coverage of Financial Markets

While Forex news websites are dedicated to the currency market, finance news sites cover a much broader spectrum of financial markets. These websites provide comprehensive coverage of stocks, commodities, bonds, and other asset classes, making them a valuable resource for investors in various sectors.

Leading finance news websites like Bloomberg, Reuters, and CNBC offer in-depth news coverage on global financial markets. These sites cover everything from corporate earnings reports to economic policy changes, giving investors the information they need to make sound investment decisions.

Understanding the Intersection Between Forex and Broader Financial Markets

Many events that affect the stock and bond markets also have a direct impact on the Forex market. For instance, when central banks announce changes in interest rates or monetary policy, currency prices often experience significant volatility. Similarly, geopolitical events such as elections, trade wars, or natural disasters can influence both financial markets and currency pairs.

Finance news websites help investors and traders track these events and understand their potential impact on global markets. This comprehensive view of the financial world allows Forex traders to make more informed decisions by incorporating broader economic trends into their strategies.

Why Accurate and Timely Information Is Crucial for Traders and Investors

Real-Time Data Drives Decision-Making

The speed at which financial markets move today means that information needs to be both timely and accurate. News that can affect the market—such as geopolitical tensions, regulatory changes, or earnings results—needs to be delivered instantly. This is particularly true for Forex traders, who are often making split-second decisions that can result in either profits or losses.

The speed and accuracy of information are paramount in Forex and finance news sites. Platforms like Investing.com and MarketWatch provide real-time data and breaking news alerts, ensuring that traders and investors are always in the loop. The ability to act quickly based on the latest news is what separates successful traders from those who miss critical opportunities.

The Role of Social Media and Community Discussions

Many Forex and finance news sites have integrated social media features, such as forums or live chats, where traders can discuss their views, share strategies, and exchange market insights. Sites like Forex Factory offer vibrant community forums where traders from around the world can engage in discussions, share analysis, and learn from each other’s experiences. These discussions often provide additional perspectives on market trends and help traders refine their strategies.

Social media platforms like Twitter, LinkedIn, and Reddit also play an essential role in the dissemination of financial news. Traders and investors often follow prominent analysts, financial journalists, and trading influencers to stay informed about the latest market movements and insights.

Top Forex and Finance News Websites to Follow

Leading Forex News Sites

- Forex Factory – One of the most popular and reliable sources for Forex news, offering real-time updates and an active trading community.

- FXStreet – Provides up-to-the-minute Forex news, economic data, and technical analysis tools for traders.

- DailyFX – Offers comprehensive market analysis, Forex news, and trading strategies.

Leading Finance News Websites

- Bloomberg – A global leader in finance news, covering financial markets, global economics, and corporate news.

- Reuters – Offers accurate, fast, and reliable financial news, along with in-depth market analysis.

- CNBC – A well-known source for breaking news in global financial markets, investment analysis, and economic data.

- MarketWatch – Covers financial markets, personal finance, economic trends, and investment strategies.

- Financial Times – A trusted name for comprehensive analysis on global financial markets, business, and economics.

In a world where the financial markets are constantly in flux, Forex and finance news websites have become indispensable tools for traders and investors. These platforms provide timely, accurate information that is essential for making well-informed decisions in a fast-paced environment. Whether it’s Forex news, stock market updates, or global economic trends, staying updated with the latest news is critical for success. As financial markets become increasingly interconnected, the role of these websites will only continue to grow, offering valuable resources for anyone looking to navigate the complex world of global finance.