EUR/USD breaks out of this scope bound price action taken over from the previous week as a rising number of Federal Reserve officials warn of a massive increase in inflation, and the exchange rate could continue to retrace the decline from earlier this season as it clears the February large (1.2243) in May.

EUR/USD BREAKS OUT OF NARROW RANGE AS DOVISH FED RHETORIC PERSISTS

EUR/USD trades into a new monthly high (1.2266) as Kansas City Fed President Esther George, who serves on the Federal Open Market Committee (FOMC) in 2022, endorses a dovish forward advice for financial policy, and it seems like Fed officials are in no rush to scale the emergency measures as the US stays"over 8 million jobs shy relative to pre-pandemic levels."

President George acknowledged that the improvements in the market as"the outlook is so strong that the debate has rapidly changed from demand shortfalls to supply constraints," but went onto state that the"factors which have boosted current inflation seem likely to fade over time" while speaking at the Kansas City Fed's Agricultural Symposium.

The remarks suggests the FOMC will keep the current course for monetary policy as the central bank plans to"keep its purchases of Treasuries and mortgage-backed securities before considerable further progress was made towards these employment and inflation goals," and it remains to be seen if the committee will adjust the forward guidance at the following interest rate decision on June 16 as Chairman Jerome Powell and Co. have been supposed to update the Summary of Economic Projections (SEP).

Until then, EUR/USD may continue to retrace the decrease from earlier this year as a growing number of Fed officials brace to get a massive rise in inflation, and a further appreciation in the exchange rate may fuel the lean in retail sentiment as the crowding behaviour from 2020 resurfaces.

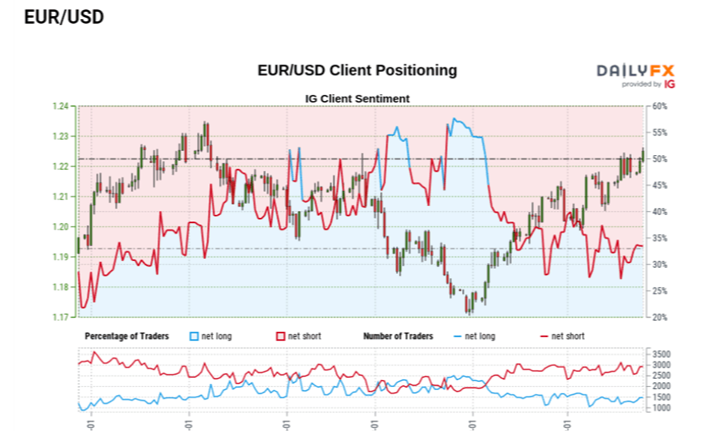

The IG Client Sentiment report shows 31.18% of dealers are net-long EUR/USD, with the ratio of traders brief to extended standing at 2.21 to 1.

The number of traders net-long is 13.67% lower compared to yesterday and 3.84% higher from last week, even while the number of traders net-short is 17.15% greater than yesterday and 7.84% higher from last week. The rise in net-long position has helped to alleviate the crowding behavior as just 28.73% of dealers were net-long EUR/USD a week, however, the lean in retail opinion seems poised to last amid the rise at net-short interest.

That said, the decrease in the January high (1.2350) can prove to be a correction from the wider trend rather than a change in EUR/USD behaviour as the crowding behavior from 2020 resurfacesas well as the foreign exchange rate may continue to exchange to new monthly highs over the coming times as it breaks out of the range bound price action carried over from the previous week.