The economic calendar is mild on the united kingdom side, therefore a lot of this focus will be on the abundance of tier 1 releases across the Atlantic, most notably the US NFP report. Therefore, the USD will probably dictate much of the price action in GBP/USD. Elsewhere, as Covid cases pick up in the united kingdom following the spread of the Indian variant, the R variety has edged higher, now ranging 1.0-1.1 from 0.9-1.1. Subsequently, with all the UK PM sounding cautious over the raising of Covid limitations planned for June 21st, dangers that the UK may need to wait could be a headwind for the currency.

GBP/USD Weekly Forecast: BoE Hawks vs UK Reopening Concerns

GBP has been able to hold onto profits stemming from BoE's Vlieghe, who provided quite hawkish remarks having discussed states in which a rate hike in 2022 could be appropriate. The move in the Pound highlights the markets elevated sensitivity to fluctuations in the position in central banks (RBNZ another instance ). Alongside this, while Vlieghe is departing the BoE at the end of August, the simple fact that he's generally more dovish relative to other MPC members may provide a sense of where the rest of the penis's stance lies. Nevertheless, currency markets are pricing in a move to 0.25% by Nov 22, a further hawkish repricing may see that change involving Q3 2022.

1

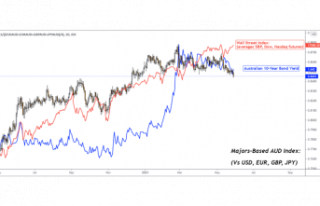

Australian Dollar Forecast: AUD/USD Might Wilt on...

2

4 Sessions Indicator for MT4

3

Slope Direction Line Indicator for MT4

4

Sentiment Indicators: Utilizing IG Client Sentiment

5

GBP/USD Weekly Forecast: BoE Hawks vs UK Reopening...

6

European health passport: available from July 1st...

7

Tax niches: those benefits you forget too often

8

Departmental elections 2021: dates, candidates, power...

9

B Clock Modified Indicator for MT4

10

SMMA Crossover Signal Indicator for MT4

BREAKING NEWS