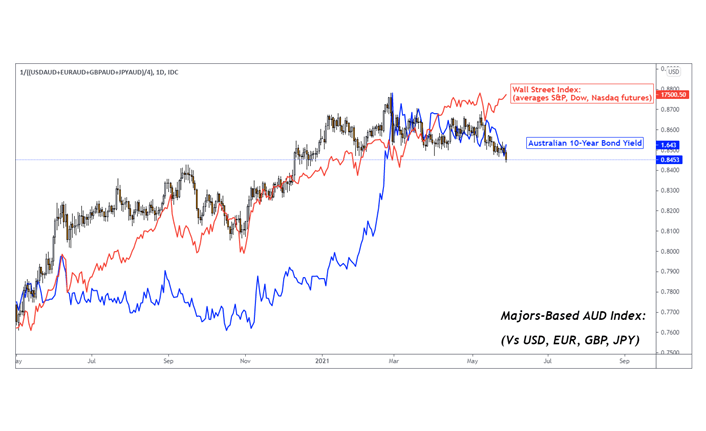

Weakness in the Aussie might have been for a few reasons. The first is the fall in iron ore prices, with all the Dalian Commodity Exchange (DCE) futures contract down over 17% by the May 12th summit. The second could be due to a decrease in Australian 10-year government bond returns, signaling the markets may be pricing in a slightly more dovish RBA. This could possibly be due to another temporary lockdown in Melbourne.

China, the world's biggest consumer of iron ore, was trying to curb steel output in an attempt to decrease pollution. In addition to this, the nation is trying to temper speculative asset bubbles. Whether the latter may prevail remains to be seen, but these attempts could cool the flourish in metals such as copper too.

The Reserve Bank of Australia is on top in the coming week. No changes in policy are expected, with regular lending rates and also the 3-year bond return target both anticipated to remain at 0.10%. But, the central bank could fortify it could roll the bond target into the November 2024 bond at their July meeting. That may uphold the idea that policy tapering may come later-than-expected.

This would also stick to a fairly disappointing regional jobs report for April, in which Australia unexpectedly lost about 30,000 positions. The markets will also be tuning into another US employment report, due on Friday. Another solid beat for wage data may revive sooner-than-expected tapering expectations, opening the doorway to weakness in global equities. All things considered, it could be another disappointing week to get AUD.