The CFPB Sues Major Banks Over Zelle Payment Fraud

In a stunning turn of events, the Consumer Financial Protection Bureau (CFPB) has taken legal action against the operator of the Zelle payments network and three major U.S. banks—JPMorgan Chase, Bank of America, and Wells Fargo. The lawsuit alleges that these financial institutions failed to properly investigate fraud complaints or provide reimbursement to victims, resulting in losses exceeding $870 million for customers since Zelle’s inception in 2017.

Zelle, a popular peer-to-peer payments network owned by Early Warning Services, has quickly risen to prominence as the largest service of its kind in the United States. However, concerns have been raised about the lack of safeguards against fraudulent activities on the platform, prompting the CFPB to intervene.

The Dark Side of Zelle

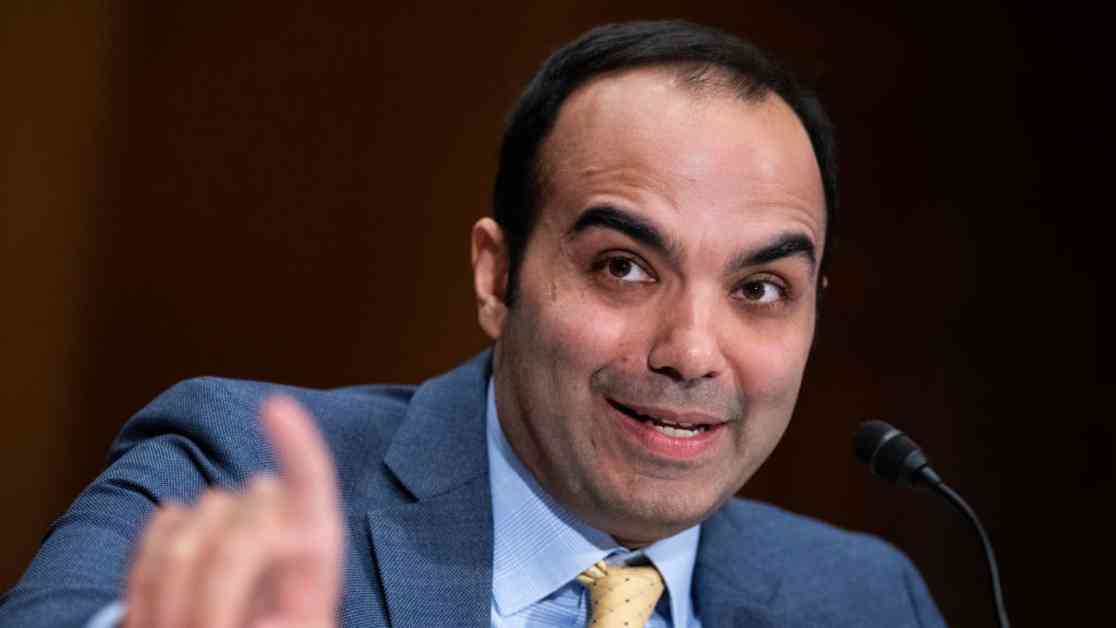

According to CFPB Director Rohit Chopra, the rise of Zelle was driven by the fear of competition from other payment apps, leading banks to prioritize speed over security. As a result, Zelle became a lucrative target for fraudsters, leaving victims vulnerable and unprotected.

Chopra highlighted the glaring flaws in the system, pointing out that the banks’ lax approach to fraud prevention allowed criminals to exploit Zelle’s limited identity verification methods. This enabled them to siphon funds undetected and move between member banks without repercussions.

Banks Under Fire

Despite the vast majority of transactions on Zelle being legitimate, a Senate report revealed that customers of the three major banks disputed $166 million in transactions as fraudulent. Shockingly, the banks only reimbursed 38% of these claims, citing technicalities that absolved them of responsibility.

The CFPB accused the banks of failing to address customer complaints and neglecting to report fraudulent activities, putting profits above customer protection. Chopra emphasized that the banks were aware of the security risks but chose to prioritize their bottom line over the safety of their customers.

A Battle of Words

In response to the lawsuit, Early Warning Services condemned the allegations as “meritless” and misleading, asserting that Zelle has robust fraud prevention measures in place. The company argued that the $870 million figure cited by the CFPB included non-fraudulent incidents, skewing the perception of Zelle’s security.

Despite the ongoing legal battle, the future of Zelle remains uncertain as regulators and financial institutions grapple with the implications of the CFPB’s lawsuit. As the story unfolds, consumers are left wondering who will ultimately bear the cost of Zelle’s vulnerabilities.

In a world where convenience often comes at a cost, the Zelle payment fraud saga serves as a cautionary tale for both consumers and financial institutions. As we navigate the complexities of the digital age, one thing remains clear—trust, once broken, is not easily regained.