CENTRAL BANK WATCH OVERVIEW:

The BOE and the ECB won't meet again for six weeks. Nevertheless, speculation about what they might do next continues to drive markets.

Throttling back its QE app is merely the beginning of the normalization process for the BOE, while increasing inflation pressures may give pause to the ECB when thinking about another easing step.

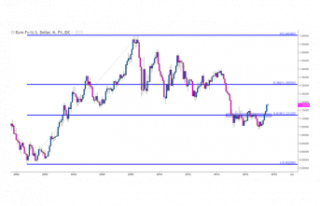

Retail dealer positioningsuggests that EUR/USD has a combined bias whilst GBP/USD includes a bullish bias.

BEGINNING TO THROTTLE BACK

In this edition of Central Bank Watch, we'll pay the two leading central banks in Europe: the Bank of England and the European Central Bank. Both banks won't meet again till late-June, giving ample space for speculation around their past, present, and future policy proceeds to dictate cost actions in EUR- and GBP-crosses. Throttling back its QE app is just the beginning of the normalization process for the BOE, while rising inflation pressures may give pause to the ECB when thinking about another easing measure.

For more information on central banks, please see the DailyFX Central Bank Release Calendar.

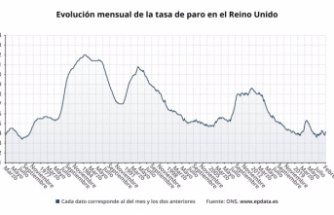

BOE ACTING AS EXPECTED

The BOE set a goal of buying #875 billion of UK government bonds through the end of 2021, also by changing the pace of QE over the upcoming few months, the BOE will no longer achieve its #875 billion target in early-October. Beyond that small adjustment at their May meeting, which otherwise produced a new Quarterly Inflation Report, BOE policy is behaving as markets expect,'steady as she goes,' as it were.

It remains the case that"rates markets continue to take BOE policymakers at their word that curiosity aren't going anywhere anytime soon, nor will the main rate move into negative territory." In accordance with overnight index swaps, there's just a 3% probability of a 25-bps speed hike in 2021 and just a 16% probability through the end of 1Q'22.

GBP/USD: Forex dealer data shows 32.91% of traders are net-long using the ratio of traders short to long at 2.04 to 1. The number of traders net-long is 14.26% lower compared to yesterday and 32.40% lower from a week, while the amount of traders net-short is 17.60% higher than yesterday and 44.12% higher from last week.

We typically take a contrarian view to audience sentiment, and the truth that traders are net-short indicates GBP/USD prices will continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent fluctuations gives us a stronger GBP/USD-bullish Forex trading prejudice.

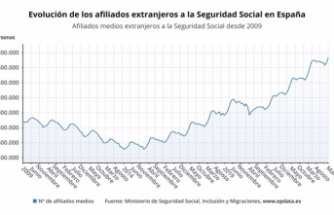

ECB LOOKING AT RISING INFLATION

The ECB has long-hinted at the chance that its monetary easing facilities might not be fully utilized throughout the exit in the coronavirus pandemic, which narrative may be invigorated this week around the April German inflation rate reading due out on Wednesday, May 12.

Although rising price pressures are widely dismissed as transitory, global bond yields remain elevated, and it's well worth mentioning that ECB Governing Council member Klaas Knot has previously said"what the market is really doing is pricing which optimism" about a comeback from the second half 2021. If higher inflation results in higher returns, then the ECB may translate it as a sign they don't need to do more about the easing front.