Tracking your success in the fast-paced world of forex trading is not just important—it’s absolutely crucial for every trader looking to level up. Whether you’re just starting out or aiming to refine your strategy like a seasoned pro, knowing how to track your forex progress like a pro trader today can make all the difference between consistent profits and frustrating losses. But, have you ever wondered what separates the top forex traders from the rest? The answer lies in their ability to monitor and analyze their trading performance meticulously, allowing them to adapt and improve continuously.

For new traders, the learning curve can be steep, and it’s easy to feel overwhelmed by charts, indicators, and market jargon. That’s why understanding how to track your forex progress as a new trader is a game-changer. It’s not just about logging trades; it’s about building a system that highlights your strengths, uncovers your weaknesses, and boosts your confidence in making smart trading decisions. Imagine having a clear roadmap that shows exactly where you’re winning and where you need to improve—sounds powerful, right?

In this article, we’ll dive deep into best practices for tracking forex performance, including simple tools and methods that even beginners can implement right away. From mastering your forex trading journal to using analytics tools that pros swear by, you’ll learn how to turn raw data into actionable insights. Ready to transform your trading journey and finally get in control of your progress? Let’s explore the ultimate strategies that will help you track your forex success like a true expert today!

7 Proven Methods to Accurately Track Your Forex Progress Like a Professional Trader

Tracking your forex progress like a professional trader is something every new trader wishes to master, but few really knows how to do so effectively. The forex market, being highly volatile and unpredictable, demands a system to keep tabs on your performance. Without proper tracking, you might end losing more than you gain or miss out on learning from your own mistakes. In this article, we explore 7 proven methods to accurately track your forex progress, helping you become a more disciplined and informed trader today.

Why Tracking Forex Progress Matter?

Tracking your forex trading performance is not just about knowing whether you make or loss money. It is about understanding your trading behavior, refining your strategy, and improving your decision-making over time. Professional traders don’t just rely on gut feelings or luck; they use data and analysis to drive their trades. By accurately tracking your trades, you can identify patterns, strengths, and weaknesses in your approach.

Historically, many successful traders used trading journals or logs to keep records of their trades. This simple habit separated amateurs from pros. In the digital age, there are more sophisticated tools available, but the principle remains the same: without tracking, you are flying blind.

1. Keep a Detailed Trading Journal

One of the easiest and most effective ways to track your progress is maintaining a trading journal. You can use a physical notebook, spreadsheet, or specialized software. The key is to record every trade with details such as:

- Entry and exit price

- Trade size and currency pair

- Date and time of trade

- Reason for entering the trade (strategy or signal)

- Outcome (profit, loss, or break-even)

- Emotional state during the trade

By having all this information, you can later analyze which strategies worked best and which emotions influenced your decisions negatively.

2. Use Forex Tracking Software

For those who prefer automation, forex tracking software can be a game-changer. Tools like Myfxbook, Forex Factory, or TradingView allow you to link your trading accounts and automatically import your trades. Benefits include:

- Real-time performance tracking

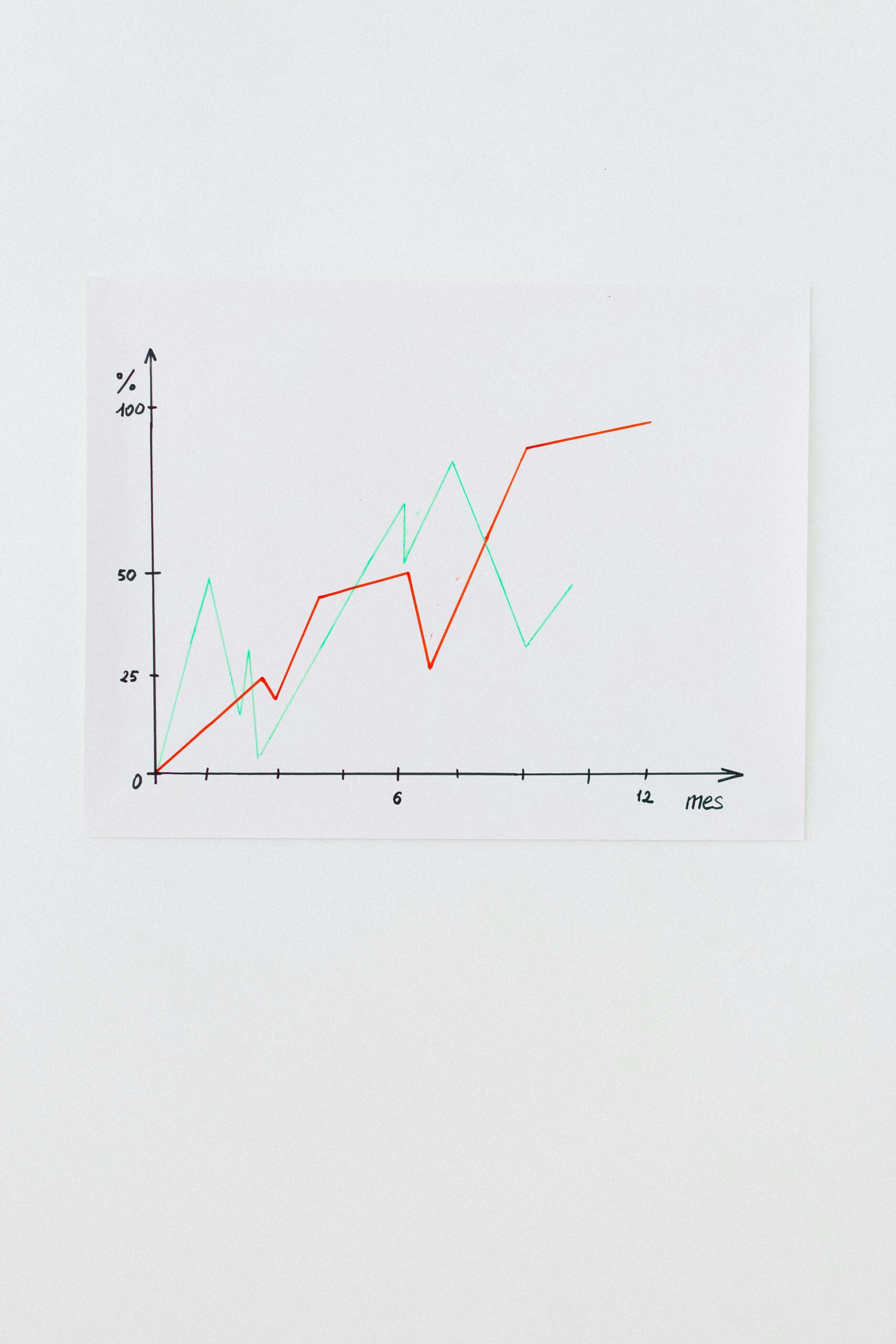

- Visual charts and graphs

- Statistical analysis like win rate, average gain/loss

- Review of trading patterns over time

Using these platforms helps traders get an objective view of their performance, eliminating human error from manual recording.

3. Analyze Your Win/Loss Ratio

A fundamental metric professional traders watch is the win/loss ratio. This tells you how often your trades are successful compared to losing ones. For example, if you win 60 trades and lose 40 in a month, your win ratio is 60%. However, this number alone isn’t enough; you must also consider the size of wins and losses. A trader who wins often but with small gains and loses rarely but with big losses might still be unprofitable.

Tracking this ratio helps in evaluating whether your trading strategy is working or needs adjustments.

4. Review Your Risk-Reward Ratio

Risk management is crucial in forex trading. Professional traders never risk more than a small percentage of their capital on a single trade. Tracking your risk-reward ratio means you compare how much you risk on each trade against the potential profit. A common rule is aiming for a minimum of 1:2 risk-reward ratio.

You can create a simple table like this to track your trades:

| Trade No. | Risk Amount | Reward Amount | Risk-Reward Ratio | Result |

|---|---|---|---|---|

| 1 | $100 | $200 | 1:2 | Win |

| 2 | $150 | $100 | 1:0.66 | Loss |

| 3 | $50 | $120 | 1:2.4 | Win |

Reviewing this data regularly will teach you to take trades that offer better rewards compared to risks.

5. Set Realistic Goals and Monitor Them

Tracking progress isn’t only about numbers but also goal-setting. Professionals have clear, measurable goals such as monthly profit targets, maximum drawdown limits, or number of trades per week. Write down your goals and check them regularly. This helps you stay focused and motivated.

Example of goal-setting:

- Achieve 5% monthly return

- Limit losses to 2% of account balance per trade

- Execute no more than 10 trades weekly

By comparing your actual performance against these goals, you can see if you are on the right path.

6. Reflect on Emotional and Psychological Factors

Many new traders forget that their emotions significantly affect their trading results. Tracking your mood or psychological state can reveal how fear, greed, or overconfidence impact your decisions. You might notice that after a big loss, you tend to revenge trade or that you feel more confident trading certain pairs.

A simple way to track emotions is rating your mood before and after trades on a scale of 1-10 or writing a short note about your feelings. This self-awareness is a key step towards trading like a

How to Use Forex Journals and Analytics Tools to Monitor Your Trading Growth Effectively

In the fast-moving world of forex trading, keeping track of your progress is more important than ever. Many new traders jump into the market without proper tools or methods to analyze their trades, often leading to missed opportunities and repeated mistakes. Using forex journals and analytics tools helps traders of all levels monitor their growth effectively, and learning how to track your forex progress like a pro trader is not as complicated as it seems. If you are new to forex and wondering how to track your forex progress, this article will guide you step-by-step on how to use these valuable resources for better trading outcomes.

What is a Forex Journal and Why It Matters?

A forex journal is simply a record of all your trades, including details such as entry and exit points, position size, currency pairs, and the reasons behind each trade. It’s a personal diary but for your trading actions. This tool allows traders to review their past decisions, spot patterns, and identify both strengths and weaknesses over time.

Historically, professional traders have always kept some form of trading journal, even before digital tools became popular. The idea is that by writing down your thoughts and results, you hold yourself accountable and make more informed decisions in the future.

Benefits of maintaining a forex journal include:

- Tracking your emotional state during trades

- Noticing recurring mistakes or successful strategies

- Measuring risk management effectiveness

- Understanding which currency pairs suit your trading style best

Without a journal, it’s easy to forget why you made certain trades or to repeat the same errors without realizing it.

Analytics Tools: The Modern Trader’s Best Friend

While traditional journals were often handwritten or typed into spreadsheets, today’s traders have access to a wide range of analytics tools that can automatically collect and analyze trading data. These platforms offer visual charts, statistics, and performance reports that make it easier to interpret your trading history.

Some popular forex analytics tools include:

- Myfxbook

- FX Blue

- TradingView

- MetaTrader’s built-in analytics

Each tool has its own features, but most provide common insights such as:

- Win/loss ratio

- Average profit and loss per trade

- Drawdown analysis

- Trade duration statistics

- Performance by time frames or currency pairs

Using these tools alongside a manual journal creates a comprehensive monitoring system. When combined, you get both qualitative notes and quantitative data — a powerful combo for accelerating your learning curve.

How To Track Your Forex Progress Like A Pro Trader Today

Professional traders don’t just trade and hope for the best; they systematically monitor every aspect of their performance. Here is a simple outline on how you can do the same:

Record Every Trade Immediately

Don’t wait until the end of the day to input your trades. Write down the details as soon as you close or open a position. This keeps your journal accurate.Note Your Reasoning and Emotions

Besides numbers, jot down why you entered the trade and what you felt. Were you confident or anxious? Emotional awareness helps improve discipline.Review Weekly and Monthly Reports

Use analytics tools to generate performance reports regularly. Look for trends like which strategies work best or if losses cluster around certain market conditions.Set Realistic Goals and Benchmarks

Define what growth means for you. Maybe it’s improving your win rate by 5% or reducing drawdowns. Tracking progress becomes meaningful when you have targets.Adjust Your Strategy Based on Data

If your journal and analytics show consistent losses on certain pairs or times, consider changing your approach rather than sticking to losing methods.

Practical Example of Forex Journal Entries

Imagine you trade EUR/USD and you want to track your progress for one week. Your journal might look like this:

| Date | Currency Pair | Entry Price | Exit Price | Position Size | Result | Reason | Emotion |

|---|---|---|---|---|---|---|---|

| 2024-06-01 | EUR/USD | 1.1000 | 1.1050 | 1 lot | +50 pips | Breakout after news | Confident |

| 2024-06-02 | GBP/USD | 1.2500 | 1.2450 | 0.5 lot | -50 pips | Overtraded after loss | Frustrated |

| 2024-06-03 | USD/JPY | 110.00 | 110.20 | 1 lot | +20 pips | Trend continuation | Calm |

| 2024-06-04 | EUR/USD | 1.1050 | 1.1020 | 1 lot | -30 pips | Reversal missed | Nervous |

By reviewing this example, you can see the impact of emotions and reasons behind winning or losing trades. You might discover you trade worse when frustrated and decide to take breaks after losses.

Comparing Manual Journals vs Automated Tools

| Feature

Step-by-Step Guide: Tracking Forex Performance for New Traders to Boost Profitability Fast

Mastering forex trading is no easy task, especially for new traders who just started dipping their toes into the fast-moving currency markets. Many beginners jump straight into trading without knowing how to track their performance properly, making it hard to see where they are winning or losing money. This article will guide you step-by-step to track your forex progress like a pro trader today, helping you boost profitability fast. You don’t need fancy software or years of experience, just a clear plan and some discipline.

Why Tracking Forex Performance Matters

Many new traders think that trading is all about finding the best strategy or the latest signal provider. But, actually, the key to success lies in understanding your own trading performance. If you don’t track what works and what does not, you’ll just repeat mistakes and get frustrated. Historically, even the best forex traders keep detailed records of their trades. Famous traders like George Soros and Paul Tudor Jones used journals to analyze their trades and improve continuously.

Without tracking, you can’t tell:

- How much you are really making or losing

- Which currency pairs perform best for you

- Your average risk-reward ratio

- The times of day your strategy works best

- Your psychological mistakes or bad habits

Step 1: Set Up a Simple Forex Trading Journal

You don’t need expensive software to start. A basic spreadsheet or even a notebook can be enough to track your trades. The key is to be consistent and honest.

Here’s what to include in your trading journal:

- Date and time of the trade

- Currency pair

- Position (buy or sell)

- Entry price

- Stop loss and take profit levels

- Exit price

- Trade size (lots)

- Result (pips gained or lost)

- Emotional state during trade (optional but helpful)

- Notes about the trade (why you entered, what you saw on charts)

Example of a simple table format:

| Date | Pair | Buy/Sell | Entry | Stop Loss | Take Profit | Exit | Size | Result (Pips) | Notes |

|---|---|---|---|---|---|---|---|---|---|

| 2024-06-10 | EUR/USD | Buy | 1.1000 | 1.0950 | 1.1100 | 1.1080 | 0.1 | +80 | Followed breakout strategy |

Step 2: Review Your Trades Weekly

Tracking is not just writing down trades but reviewing them regularly. Set a time each week to analyze your journal. Look for patterns such as:

- Are you losing more during certain times or days?

- Which setups give you most profits?

- Are you sticking to your stop loss or moving it?

- How often do you exit before your take profit?

By evaluating your trades with fresh eyes, you can find strengths and weaknesses. For example, many new traders fail to cut losses fast, holding onto losing trades hoping for a rebound, which tracking will quickly expose.

Step 3: Use Metrics to Measure Performance

Pro traders don’t just look at profit and loss but use several performance metrics. Here are few you should consider:

- Win rate: Percent of winning trades vs total trades.

- Average win/loss: How much you gain on winning trades vs how much you lose on losing ones.

- Risk-reward ratio: Average profit compared to average loss.

- Max drawdown: The largest peak-to-trough loss in your account.

- Profit factor: Total profit divided by total loss; above 1 means profitable.

Tracking these will give you a clearer picture than just looking at your balance. For example, a high win rate but low risk-reward ratio might mean you need to adjust your exit strategy.

Step 4: Embrace Technology But Don’t Depend Fully

There are many trading journal apps and platforms that can automate tracking, like Myfxbook, Edgewonk, or TraderVue. These tools offer advanced analytics and visual reports. But remember, new traders sometimes rely too much on tech and forget the discipline behind tracking.

If you use software, still spend time reviewing individual trades yourself. Numbers and charts help but understanding your mindset and reasons behind each trade is equally important.

Practical Example: Tracking Progress Over One Month

Imagine you started with $1,000 and placed 30 trades in a month. By the end, your journal shows:

- 18 wins, 12 losses (60% win rate)

- Average win 50 pips, average loss 30 pips

- Risk-reward ratio about 1.6

- Max drawdown 10% of account

- Profit factor 1.5

From this data, you learn that your win rate is decent but you can improve your risk-reward ratio. Perhaps you are exiting too

What Are the Best Metrics and KPIs to Measure Your Forex Trading Success in 2024?

Forex trading has always been a challenging arena where traders try to make sense of fluctuating markets and unpredictable news. In 2024, the environment seems even more volatile, making it critical to know how to track your forex progress effectively. Many traders, especially beginners, ask, “What are the best metrics and KPIs to measure your forex trading success in 2024?” or “How to track your forex progress like a pro trader today?” Well, this article try to break down some key concepts that can help you monitor your trading journey, no matter if you just started or been trading for a while.

What Are Metrics and KPIs in Forex Trading?

First, we should understand what metrics and KPIs actually mean. Metrics are the raw data points or measurements that give you insight into your trading activity. KPIs (Key Performance Indicators) are more focused metrics that directly indicate how well you are achieving your trading goals. Not every metric is a KPI, but every KPI is a metric that matters most.

In forex, these can relate to your profit, risk, trade frequency, or even psychological factors like discipline and patience. Tracking these numbers is essential but knowing which ones really matter is the trick.

Best Metrics and KPIs to Measure Forex Trading Success in 2024

The forex market changes fast, and so should the way you measure success. Here are some important metrics and KPIs that traders use today:

Win Rate (Winning Percentage)

- This metric shows how many trades you win versus lose, expressed in percent.

- Example: If you made 100 trades and won 55, your win rate is 55%.

- While important, win rate alone can be misleading because even a high win rate trader can lose money if losses are big.

Risk-Reward Ratio

- Tells you how much you risk compared to how much you expect to gain.

- For example, risking $100 to gain $300 means a 1:3 risk-reward ratio.

- Pro traders often aim for a risk-reward ratio higher than 1:2 to stay profitable long term.

Profit Factor

- The ratio of gross profits to gross losses.

- If your profits are $10,000 and losses $5,000, your profit factor is 2.0.

- A profit factor above 1 indicates profitable trading.

Average Return Per Trade

- Total net profit divided by the number of trades.

- This helps you understand the average efficiency of each trade.

Maximum Drawdown

- The largest loss from a peak to a trough before a new peak.

- This metric helps you understand worst-case scenarios and manage risk better.

Expectancy

- A little complex but super useful KPI.

- Formula: (Win rate × Average win) – (Loss rate × Average loss).

- It tells you the average amount you can expect to win or lose per trade.

How To Track Your Forex Progress Like A Pro Trader Today

Tracking forex progress is not just about writing down trades, but analyzing them deeply. Pro traders use a combination of tools and techniques to keep their trading sharp. Here’s how you can do it:

Use Trading Journals Regularly

- Write down every trade with details: entry, exit, stop loss, take profit, reasons for trade, and emotional state.

- Reviewing journals weekly or monthly helps spot patterns and mistakes.

Leverage Trading Software and Apps

- Platforms like MetaTrader, TradingView, or specialized software like Edgewonk or TraderSync help automate tracking.

- They provide reports on KPIs like win rate, drawdown, and profit factor.

Set Clear Trading Goals

- Without goals, tracking progress is meaningless.

- Examples: “Increase monthly return by 5%” or “Reduce drawdown to less than 10%.”

Regular Performance Review Sessions

- Schedule weekly or monthly review sessions to analyze trades.

- Look at what worked, what didn’t, and plan improvements.

Monitor Emotional and Psychological Metrics

- Track stress levels, confidence, and discipline.

- Forex is as much mental game as numbers; emotional KPIs matter.

How to Track Your Forex Progress as a New Trader

Starting out can be confusing with so many metrics and advice out there. New traders should keep it simple and focus on building good habits.

Start With a Basic Trading Journal

- Note down the trade setup, entry price, exit price, and why you took the trade.

- Even a simple spreadsheet can work wonders.

Focus on Win Rate and Risk-Reward Ratio First

- These two KPIs show if your strategy is working or needs tweaking.

- Avoid obsessing about profits at the start; focus on consistency.

Unlock the Secrets: How Top Forex Traders Consistently Track and Improve Their Trading Results

Unlock the Secrets: How Top Forex Traders Consistently Track and Improve Their Trading Results

Forex trading is a complicated world where many traders try to succeed but few consistently make profits. One of the biggest secrets that top forex traders don’t often talk about is how they track and improve their trading results day after day. If you are new to forex or even struggling with your current trading, learning how to track your progress like a pro trader is crucial. It’s not just about making trades randomly and hoping for the best, but rather, carefully analyzing what works and what doesn’t.

Why Tracking Your Forex Progress Matters

Many new traders jump into the forex market without any plan to track their trades or results. This is like driving a car blindfolded — you don’t know where you are going or how far you’ve traveled. Tracking your forex progress helps you:

- Understand your strengths and weaknesses

- Identify patterns in your trading behavior

- Measure your risk and reward effectively

- Improve your strategies over time

- Avoid repeating the same mistakes

Historically, some of the most successful traders, like George Soros and Stanley Druckenmiller, have kept detailed journals of their trades and market conditions. It wasn’t luck that made them successful, but disciplined tracking and learning from every trade.

How Top Forex Traders Track Their Trading Results

Professional forex traders use a variety of tools and techniques to monitor their performance. Here’s a look at what they commonly do:

Keep a Trading Journal

This is the most basic but important step. Top traders write down every trade, including entry and exit points, position size, reasons for making the trade, and emotional state during the trade. This helps them review what decisions were good or bad.Use Spreadsheet or Trading Software

Many traders use Excel or Google Sheets to organize their data. Some prefer specialized software like Myfxbook or TradingView, which provide detailed analytics and charts showing their performance over time.Calculate Key Metrics

Successful traders don’t just look at profits and losses. They calculate metrics like:- Win rate (percentage of winning trades)

- Risk-to-reward ratio

- Average profit per trade

- Maximum drawdown

- Expectancy (average return per trade)

Review and Reflect Regularly

They don’t just collect data and forget it. Weekly or monthly reviews help them spot mistakes, adjust strategies, and set new goals.

How To Track Your Forex Progress Like A Pro Trader Today

If you want to start tracking your forex results like a professional, here is a simple roadmap you can follow immediately:

Step 1: Create a Trading Journal

Write down every trade details you can remember. For example:- Date and time

- Currency pair

- Entry price

- Exit price

- Position size

- Stop loss and take profit levels

- Reason for entering trade

- Result (profit or loss)

- Emotions felt during trade (nervous, confident, rushed)

Step 2: Use a Spreadsheet to Log Your Trades

Set up columns for each item in your journal. This will help you quickly see patterns such as which currency pairs you trade best or what times of day are most successful.Step 3: Calculate Your Performance Metrics

Every week, calculate your win rate and average profit or loss. This will tell you if your strategy is improving or needs changes.Step 4: Analyze Mistakes and Successes

Look back at trades that lost money or made a big profit. Ask yourself what could be done differently or repeated.Step 5: Set Measurable Goals

For example, target a 55% win rate this month or limit your losses to 2% of your trading account per trade.

How to Track Your Forex Progress as a New Trader

Starting out in forex trading can be overwhelming. You have charts, indicators, and news all competing for your attention. It’s easy to lose track of your progress or get discouraged. Here’s some tips especially for beginners:

Start Small and Simple

Don’t try complex tracking tools in the beginning. Use a notebook or simple spreadsheet. Focus on recording only the most important trade details.Focus On One or Two Currency Pairs

Tracking too many pairs can confuse you. Pick the pairs you want to learn first and track them carefully.Don’t Forget the Emotional Side

New traders often ignore how emotions affect trading. Writing down how you felt before and after trades can reveal patterns like overtrading when stressed or hesitating when confident.Compare Your Results to Benchmarks

Try to compare your trading performance against common benchmarks like a 50% win rate or a 1:2 risk-to-reward ratio. This

Conclusion

Tracking your progress as a new forex trader is essential for continuous improvement and long-term success. By consistently maintaining a detailed trading journal, analyzing your trades objectively, and setting measurable goals, you create a clear roadmap for growth. Utilizing tools such as performance metrics and trading platforms can provide valuable insights into your strengths and weaknesses, helping you make informed decisions. Remember, patience and discipline are key—progress may be gradual, but with persistence, you will develop greater confidence and expertise. Make it a habit to review your strategies regularly, learn from both your wins and losses, and adapt accordingly. Ultimately, the journey of tracking your forex progress not only sharpens your skills but also builds the mindset needed to thrive in the dynamic forex market. Start implementing these tracking methods today and take control of your trading journey toward consistent profitability.