(Information sent by the signing company)

Todosegurosmedicos.com explains what are the causes that have led insurance companies to increase the price of their insurance and offers the solution to pay as little as possible for the health policy

Why does the price of private medical insurance rise? The annual rise in the health premium is usually common due to the increase in the cost of health services. But this last year the increase has been higher than usual. Covid-19 has a lot to do with this.

The pandemic has meant and means the increase in health demand by the population, the massive use of high-tech diagnostic tests, and the incorporation of the latest medical, pharmacological and technological advances, as well as a commitment to preventive medicine. This without forgetting the general increase in the cost of living.

Can the company raise the price of medical insurance? The obligations derived from a contract are a two-way road: they affect both the policyholder and the insurer.

"The insurer must notify the policyholder, at least two months before the end of the current period, of any modification of the insurance contract."

What to do if the price of health insurance goes up? Today, with such large waiting lists in public health, having health insurance is a basic need at any age. That does not imply that it is not necessary to save on this product. It must be sought, just like on the shopping list or on energy bills, to combat rising inflation due to the war in Ukraine.

During the month of November, insurers are sending letters to their clients explaining the price increases of their policies. Well, now is the time to change companies if the current one has raised the amount of premiums a lot or the medical needs have changed. To do so, the insured only has to notify one month in advance that he wants to terminate the contract, as established by the link.

Leaving it for December implies not complying with this notice. Nor is it an alternative to return the receipt in January, since the insurer may consider that the termination was not communicated (indeed, no one has communicated it) and request payment for the entire year.

Todosegurosmedicos.com has the solution to the price increases of health policies, helping to achieve the cheapest medical insurance with the most complete coverage. It is so because:

What is the advantage of changing the insurance for one with limited copays? With this option, you pay little each month for health insurance and you pay a small amount for each medical act, but without any surprises, since if you need to use the service has an annual cap, which is usually around €200-300. If it is exceeded, no more is paid for the remaining ones.

In this way, if the insurance is not used, very little is paid. But if you have the need to use it more frequently, you know what the limit is that you are going to pay. This alternative is, on many occasions, cheaper than insurance without copays.

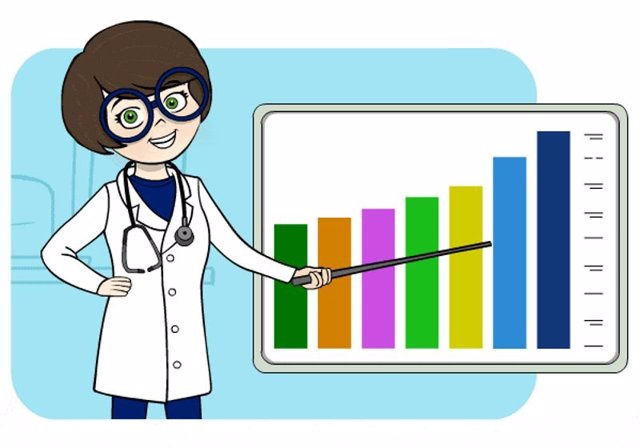

This example of the comparator of Todosegurosmedicos.com helps to understand what a 36-year-old man, resident in Madrid and employed by others, can save if he chooses a comprehensive policy with limited copays.

With health insurance with limited copays you can save up to 50%

Conclusion. Although health insurance has gone up, it is still possible to save. You have to compare and look for the best offer before signing the new 2023 policy. November is the best month to do it and comprehensive health insurance with limited copays is a good alternative to be able to face all the usual payments while the term lasts. crisis.

www.todosegurosmedicos.com is a Globalfinanz website, a leader in the sale of health and life insurance online, with more than 40,000 clients and agreements with more than 60 insurance groups.

ContactContact name: todosegurosmedicos.comContact description: Contact telephone number: 91 218 21 86