Currency volatility, often measured by calculating the standard deviation or variance of currency price movements, gives traders an idea of how much a currency might move relative to its average over a given time period. A currency pair's true range can be used to gauge volatility. Traders also have the option of looking at percent spot.

Higher levels of currency volatility mean higher levels of risk. Risk and volatility are often interchangeable terms.

Trading volatile currency pairs can offer traders higher potential rewards. Although, this increased potential reward does present a greater risk, so traders should consider reducing their position sizes when trading highly volatile currency pairs.

What are the MOST VOLATILE CURRENCY PARTS?

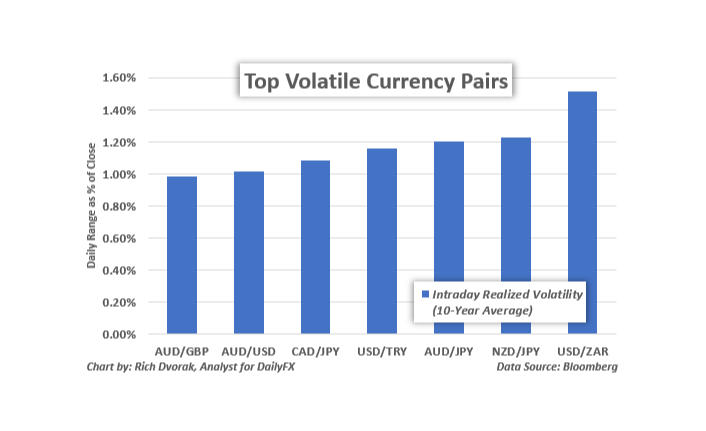

These are the most volatile major currency pairs:

- AUD/JPY (Australian Dollar/Japanese Yen)

- NZD/JPY (New Zealand Dollar/Japanese Yen)

- AUD/USD (Australian Dollar/US Dollar)

- CAD/JPY (Canadian Dollar/Japanese Yen)

- AUD/GBP (Australian Dollar/Pound Sterling)

The major currency pairs EUR/USD, USD/JPY and GBP/USD are more liquid and less volatile than other major currencies. However, emerging market currency pairs such as USD/ZAR and USD/TRY can have some of the highest volatility readings.

MOST VOLATILE CURRENCY AIRS

Majors - AUD/JPY, NZD/JPY, AUD/USD, CAD/JPY, GBP/AUD

Emerging Markets: USD/ZAR/USD/TRY, USD/MXN

Emerging market currencies are highly volatile due to their inherent risk. The chart below gives an example of how volatile emerging market currencies can be, which shows USD/ZAR (US Dollar/South Africa Rand) exploding nearly 25% higher in just over a month's time. You can find many other examples throughout history of emerging market currency pairs that swing dramatically like this.