- The third week in July is quieter for Australia's economic calendar. There are no 'highly rated' events on the DailyFX Economic Calendar.

- The Citi Economic Surprise Index for Australia closed the week at +35.8, slightly less than its closing level of +38.2.

- The IG Client Sentiment Index suggests that both AUD/JPY rates and AUD/USD rates are bearish.

AUSTRALIAN DOLLAR'S TOUGH WOEEK

There is nothing good happening down under. The Australian Dollar has had a poor performance in July, even though it is a more stable month. The Australian Dollar ended the week at its weekly, monthly, and annual lows. Its performance was as follows: AUD/JPY fell by -1.33%, AUD/USD dropped by -1.32%, EUR/AUD increased +0.65%, and GBP/AUD gained -0.34%. The Australian Dollar has been left without any positive catalysts due to its continued lockdowns in the face already weakening economic data.

AUSTRALIAN ECONOMIC CALENDAR QUIETS DOWN

The third week in July is quieter for Australia's economic calendar. There are no 'highly rated' events on the DailyFX Economic Calendar. The most important release for the week is the July RBA Minutes on Tuesday, July 20, at 2:35 pm. Overall data trends seem to be declining relative to expectations. The Citi Economic Surprise Index for Australia closed the week at +35.8, slightly less than its closing level of +38.2.

RELATIVELY SPEAKING: RBA IS DOVISH

The Reserve Bank of Australia is a bit different from its counterparts. While the Federal Reserve has hinted at withdrawal of stimulus, the Bank of Canada, as well as the Reserve Bank of New Zealand, have taken concrete steps to reduce asset purchases. The RBA has been transparent and suggested that they will continue to use stimulus until the headline Australian inflation returns below its +2-3% target range. In 1Q'21 it was just +1.1% annually.

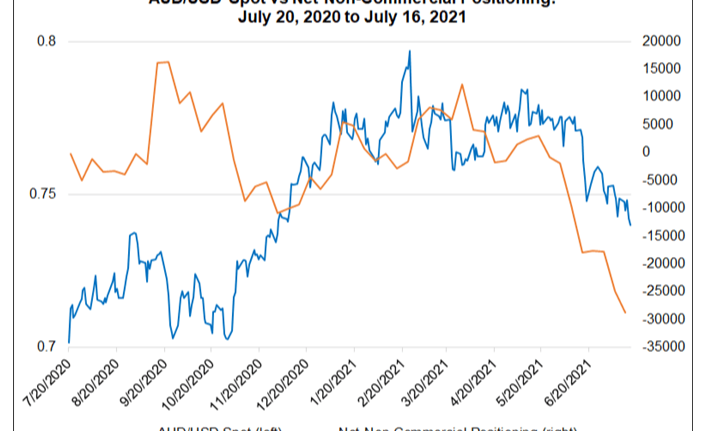

Finally, speculators have increased their net short position in Australian Dollars to 28,788 contracts according to the CFTC COT for week ended July 13. This is an increase of 24,870 contracts that was held the week before. The Australian Dollar position has become increasingly short over the past four weeks and has been net-short ever since May 25th.