FUNDAMENTAL FORECAST FOR AUSTRALIAN DOLLAR: NEUTRAL

AUD/USD snapped the launching scope for January since the Federal Open Market Committee (FOMC) vowed to"raise our holdings of Treasury securities by $80 billion each month and of bureau mortgage-backed securities by $40 billion monthly," and it appears like Chairman Jerome Powell and Co. are in no hurry to further use its unconventional instruments as"monetary policy will probably helphouseholds and companies weather the recession in addition to limit lasting harm to the market."

The RBA will follow a similar strategy after announcing plans to buy"$100 billion of government bonds of maturities of about 5 to a decade over the next six months" in November, along with the central bank could rely on its own existing steps to encourage the market since the"2020-21 Budget commits additional response and recovery service, bringing the Government's entire support to $507 billion, including $257 billion in direct financial aid."

Subsequently, that the RBA may follow the identical script because the minutes from the December meeting highlight that"the Board's policy steps had reduced interest rates throughout the yield curve, which had been helping the recovery," and Governor Philip Lowe and Co. may mainly endorse a wait-and-see strategy for financial policy as"members agreed to maintain the magnitude of this bond purchase plan under review."

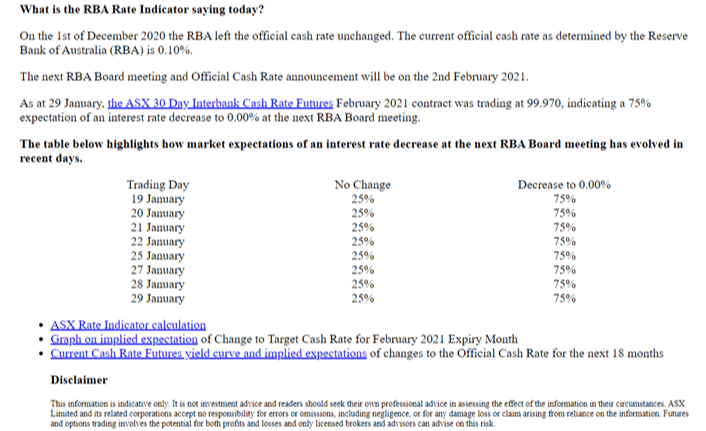

On the other hand, the ASX 30 Day Interbank Cash Rate Futures signify a higher than 70% likelihood for a RBA rate decrease as"that the Board is ready to do more if required," and also an abrupt decrease in the official cash rate (OCR) could endanger the recent rally in AUD/USD because Governor Lowe and Co. continue to drive financial policy into uncharted land.

That said, the same in the RBA may activate a bullish response in the Australian Dollar amid speculation to get a rate reduction, along with the pullback in the monthly high (0.7820)can prove to be an fatigue from the bullish trend as opposed to an alteration in AUD/USD behaviour like the cost activity seen in the next half of 2020.