It now looks like it will continue to fall before the results of the European Central Bank strategy review, which will likely be revealed in September, but could also emerge earlier.

In January 2020, the ECB's policy-making Governing Board announced that it was reviewing its monetary policy strategy. The results were to be published by end of last year. This deadline was not met, which is not surprising. The markets have largely ignored the review since then, focusing instead on the coronavirus epidemic, the global economic downturn that followed, and, more recently, the recovery of the slump and the possibility of rising inflation.

The ECB has made it clear that it does not intend to tighten its policy in the near future, as has other central banks who have said that inflation is likely to be temporary. The review will confirm that message. It will state more explicitly that the ECB will accept inflation it considers temporary. Investors will begin to pay attention to what the Euro might say.

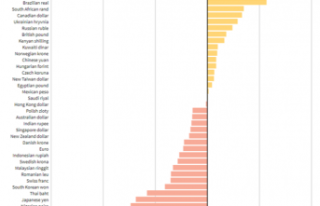

EURO REVISED INFLATION TARGET NEGATIVE

One outcome of the review could include a revised inflation target. The ECB may change its current definition of price stabilization to mean "a year-on–year increase in Harmonised Index Consumer Prices (HICP for the Euro zone of below 2%". In 2003, the Governing Council stated that it aims to keep inflation rates below, but near, 2% in pursuit of price stability.

That could be changed to a symmetric medium term inflation target of 2%. The ECB will tolerate inflation above and below this level. This would be a continuation of low interest rates, bond-buying, and quantitative easing in the current environment. However, inflation should not rise above 2% to slow the recovery's infancy.

CHRISTINE LAGARDE - LISTEN OUT

Market pricing is a reflection of expectations, so Euro weakness could be a possibility before publication. This means traders will need to keep an eye out for clues from Governing Council members, and especially from Christine Lagarde, President of the ECB. One hint she dropped was in June, when she suggested that Politico.EU could use the US Federal Reserve policy framework as a template.

"We reviewed the Federal Reserve's output - their average inflation targeting with an asymmetrical symmetry and a focus on employment. She said that this is what they do and what has worked for their strategy review. She added that it doesn't prejudge what will work and that our work is not complete.

Download our 3Q trading guide, DailyFX Free Trading Guides, to see the complete Euro forecast and technical outlook!