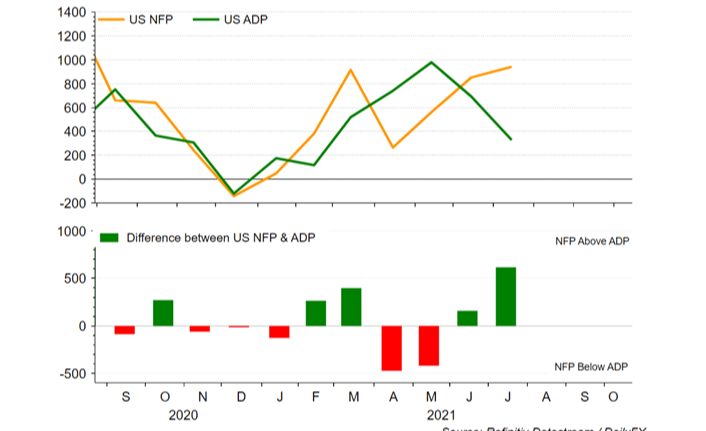

The market participants are waiting for key data releases, such as NFP and ISM, which will help to muffle price action in the precious metal. Today's ADP report will be a big draw, but the predictive value of the data for NFP has been less than stellar in recent months. Last month was a notable example of this, as the data points revealed the largest disparity over a year. The data is relevant for markets as they prepare for the NFP report.

CLOSE TO THE ABOVE DOUBLE TOP REQUIRED FOR BULLISH ELITIMENT

However, gold is still hovering around its 200DMA (1810). While yesterday's session saw support for dips to 1800, it is hard to believe that further upside will be possible until a close above 1830-35. This is especially because momentum indicators (RSI), are again stalling. Taking a look at 10yr real yields they are off the lows and thus approaching last months highs, a factor that is likely to keep the gold prices suppressed, despite the USD seeing a 1% pullback from its recent multi-month peak. If the US employment statistics show a soft side, gold could rise towards 1830 to 35. Support is at 1770-75 while the pivotal level at 1760 is the negative. This level has been a level that I have observed in precious metals for the past year.

Outlook Mixed: IG Client Sentiment

According to retail trader data, 70.52% of traders are net long with the ratio of traders short to long at 2.39 to 1. The net-long trader number is 0.377% higher than yesterday, 1.29% lower than last week, and the ratio of traders long to short is 2.39 to 1.

We tend to take a contrarian approach to crowd sentiment. The fact that traders are net-long suggests that Gold prices could continue to fall.