The Bank of England is expected to keep its current financial policy, the corresponding statement is very likely to emphasise short-term downside risks to signify the current surge in virus instances and following national lockdown. But as has become the case with most central banks, I expect the BoE to stay optimistic about the financial outlook for H2 21, especially using the UK enjoying a somewhat prosperous vaccine rollout program.

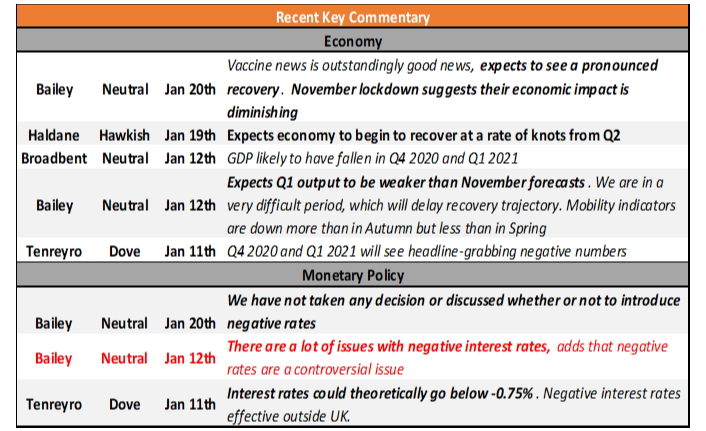

Nevertheless, possibly the most focus will be put on the BoE outcomes in the appointment it started with banks back in October regarding damaging prices. Therefore, there's a possibility that the BoE may print a wider review, which might well discover that negative interest rates are operationally viable. But this doesn't follow that the BoE will inevitably return this origin. For the time being, adjusting strength purchases stays the central bank's most important response function. It's worth mentioning that outside members like Tenreyro are more open to adverse rates while inner members such as the Governor are less pressing (A listing of crucial BoE comment is revealed below).

The current run of stronger than expected economic data and particularly, the annual inflation figures (RBNZ's Sectoral Factor Inflation at 1.8percent ), have observed neighborhood banks away from calling for extra RBNZ rate reductions. Another factor has been the uncontrolled housing market, that has caught the central bank by surprise and consequently has witnessed the RBNZ Chief Economist prediction a tapering of QE this past year.