- Both the U.S. government and China are punishing U.S.-listed Chinese tech companies

- Are falling U.S. Treasury yields pre-empting another COVID-19 surge?

- Market uncertainty continues to grow as a result of ongoing talks between OPEC+ countries

CHINESE CRACKDOWN OVER DIDI MAY HAVE CONTAGION EFFECT ABROAD GLOBAL STOCKET MARKETS

Tensions between the USA and China are returning as Chinese companies are being affected by both countries, particularly U.S.-listed Chinese companies and those with alleged links to military surveillance and/or technology. On June 3, President Joe Biden issued an order banning U.S. investments in Chinese companies. This has caused havoc for index listings worldwide as many publishers plan to revise their issuances and remove the Chinese companies.

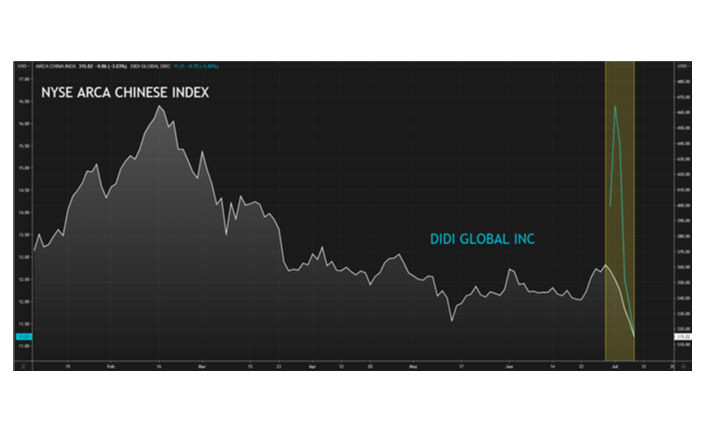

DiDi (DIDI), the Chinese equivalent to Uber, was the headline this week. He recently listed on the and NYSE. The Cyberspace Administration of China ( CAC), placed the company under review, and imposed a ban on new users. After a directive by the Chinese government to crack down on large technology companies, the ban was upgraded to include the removal of the ride-service from the app store.

The chart below shows the decline in U.S.-listed Chinese companies "with large exposures the Chinese economy". (Source: NYSE.com). This was following announcements from the Chinese and U.S. Other peer listings, such as Baidu, Baidu, and Alibaba are also suffering from a sharp decline in DiDi. US-China communication is crucial in order to avoid another clash between these heavyweights, as their actions can have serious consequences all around the globe.

FALLING U.S. 10 YEAR TREASURY YIELDS CAN PERSIST AS GLOBAL COPID-19 CASES RISE

The COVID-19 pandemic, which has been lingering behind other financial market trends, is starting to creep into analysts' minds. Recent falls in U.S. Treasury yields may be a repetition of the initial fall seen at the end of 2019. (See chart below - white). The virus's Delta variant is spreading around the world, causing policymakers concern.

This may lead to a risk-off approach, which could result in a greater number of people flocking to the U.S. Treasury and a decrease in yields. This is concerning because vaccine rollouts in many countries that are close to developing nations are under way. However, there are more cases than ever before which could lead to additional market disruptions.

Financial discussions are also dominated by taper talk. This could lead to falling yields if the U.S. reduces its bond buying. The Federal Reserve is closely watching this situation in order to make the right decision without worrying markets.

GLOBAL COVID-19 VS U.S. 10 YEAR TREASURY YIELD

TWO SIDES TO CRUDE OIL COIN - FLOP OR FLY

This week, the Organsiation of the Petroleum Exporting Countries(OPEC+) was at an impasse as Russia blocked attempts by the alliance for output restrictions to be extended to the end of 2022. Two possible outcomes could be expected.

- There is no agreement and member countries fight for supply dominance, which will likely lead to a sharp fall in crude oils prices.

- UAE accepts the constrained output extension, which could further support the current uptrend in crude oils prices.