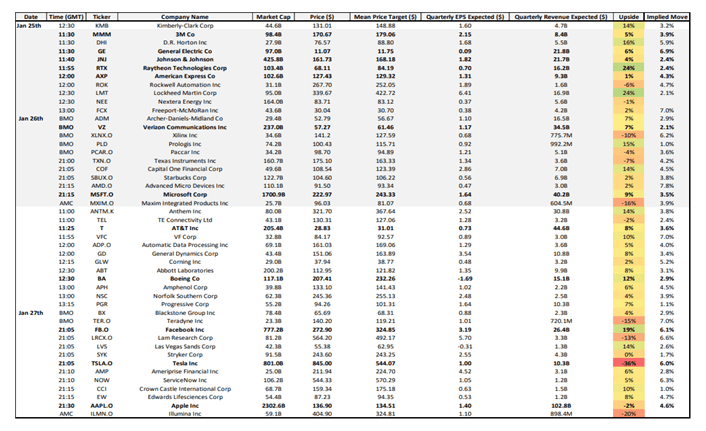

Earnings season will continue this week as the nations largest financial institutions pass the baton into some of the strongest companies in other industries. As January approaches its conclusion, risk appetite has become quite fragile and the upcoming quarterly reports will likely play a important part in either repairing damaged belief, or shattering it altogether.

As for the Dow Jones especially, names like 3M, Johnson & Johnson and Boeing will offer key insight into industries essential to the economy outside of technology. Boeing was recently included in our listing of three stocks to watch in the week ahead because of its recovery efforts and a solid earnings performance could help reestablish what was formerly the highest-weighted associate of the Industrial Average. If Boeing reclaim its former place, it would account for more than 10 percent of this index and may help close the gap between the Nasdaq 100 and Dow.

The Nasdaq 100 may even face implications from forthcoming reports as tech giants Apple, Facebook, Microsoft and Tesla are set to report next week. They're joined by a plethora of other Nasdaq associates, but the four companies account for almost 30% of the whole index. A strong quarter from Netflix offered a kickstart to belief surrounding technician earnings, however, the behemoths will need to deliver on lofty expectations if risk appetite is to remain intact.

While undoubtedly important, the corporate findings will have to jostle for influence over the market as investors also anticipate a midweek Federal Open Market Committee meeting at which no change to the interest rate range is expected.

Besides interest rates, market participants will likely parse through comment on returns and the Fed's view of inflation.

While the US indices juggle central bank comment and reports from companies on the floor, the DAX 30 will seem to broader economic information. GDP and employment figures are the headliners and are united by a series of different readings on the market. Nevertheless, DAX 30 volatility could lag that of the US indices and it might track its US counterparts consequently. In the meantime, follow @PeterHanksFXon Twitter for updates and evaluation.