It estimates that GDP accelerated its advance to 0.6% in the second quarter and lowers its CPI forecast to 3.2% for this year

MADRID, 19 Jun. (EUROPA PRESS) -

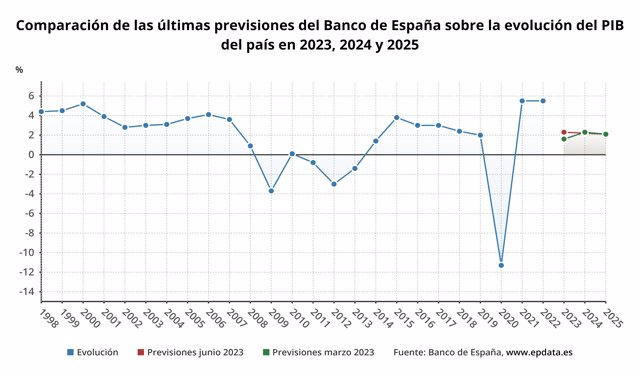

The Bank of Spain has revised its growth forecast for the Spanish economy by 2023 upwards by seven tenths, from 1.6% to 2.3%, as a result of a "more intense" advance in activity in the first months of year and the review made by the National Institute of Statistics (INE) of the GDP data for the last quarters of 2022, which together explains five of the seven tenths of improvement in its estimate for 2023.

In this way, the general director of Economy and Statistics of the Bank of Spain, Ángel Gavilán, has indicated that the improvement in GDP projections for 2023 is mainly due to "past data", since the growth prospects for the coming quarters do not undergo significant changes.

The rest of the upward revision to this year's growth is due to the fact that the dynamism of activity in the second quarter will be higher than expected in their March projections. Specifically, for the second quarter of this year, the Bank of Spain estimates quarter-on-quarter growth of 0.6%, one tenth higher than in the first quarter, due to the greater dynamism of household consumption.

However, Gavilán has warned that, although the prospects for the second quarter are good, "the trend is downward" given the "signs of weakness" that certain indicators are sending in recent weeks, such as confidence, investment in housing or certain dynamics in the labor market, signs that have been disconnected from the call for general elections for July 23.

For 2024, the Bank of Spain has revised its growth forecast downward by one tenth, to 2.2%, mainly as a reflection of a more intense tightening of credit granting conditions than anticipated in March, while which maintains that of 2025 at 2.1%.

In its report on macroeconomic forecasts for the month of June, the institution underlines that the weakening of inflationary pressures, with commodity prices "somewhat more favorable" for growth in 2023 than those estimated in its projections last month March, and the pace of execution of projects associated with European funds, will allow the expansion of activity to continue for the rest of the year.

However, it warns that this effect will be offset by the more negative impact on activity that the tightening of financing conditions will have due to the rise in interest rates to contain inflation.

Gavilán has stressed that the European funds will be an important support for economic growth in the coming years, but has warned that their final impact will depend on how they are allocated.

In this sense, he pointed out that, with the information available, the tenders linked to the funds are being awarded to "relatively large" companies and with few difficulties in accessing credit, except in the case of the Digital Kit, aimed at SMEs. However, Gavilán has defended that supporting smaller companies could accelerate their development and contribute positively to investment in the long term.

The General Director of Economy and Statistics of the Bank of Spain has stressed that the Spanish economy will grow until 2025 at a rate higher than that of the euro area, although this will still not allow closing the gap that opened between Spain and the euro zone, in terms GDP level, at the beginning of the pandemic.

Gavilán pointed out that, with the data for the first quarter, Spain is already practically at pre-pandemic levels in terms of GDP and above it in terms of the number of employed.

With regard to inflation, the agency has lowered half a point, to 3.2%, the average rate for this year due to a "more pronounced than expected" deceleration in energy prices and, to a lesser extent , in food prices, whose growth is considered to have "peaked, with a high probability", in February of this year, when they shot up 15.7%.

Specifically, it calculates that headline inflation will be below 2% in June, although it will pick up in the second half of the year due to the base effect of energy prices and the withdrawal of anti-crisis measures, a trend that will continue in 2024, the year for which it maintains its forecast of an average CPI of 3.6%, to drop later, in 2025, to 1.8%.

Although salaries will increase in real terms in the coming years, Gavilán has indicated that second-round effects on inflation are not expected because lower growth in corporate profits is expected. In addition, he believes that the risk of these effects occurring via wages has been reduced with the signing of the interconfederal collective bargaining agreement for 2023-2025 between unions and employers.

In the case of core inflation, the institution is revising its projections for March 2023 upwards by two tenths, to 4.1%, and lowers those for 2024 and 2025 by one tenth, to 2.1% and 1. 7%, respectively.

The Bank of Spain points out that, in a context in which the degree of uncertainty continues to be high, the risks surrounding growth projections "are fundamentally downward-oriented, while, in the case of inflation, they are considered relatively balanced."

The Bank of Spain expects the "solidity" shown by job creation to continue until 2025, so that the average unemployment rate will stand at 12.2% this year (half a point below the estimate in March). , at 11.5% in 2024 (compared to the 12.3% estimated three months ago) and at 11.3% in 2025, seven tenths less than in their March calculations.

In its new projections, the Bank of Spain improves its estimates on the deficit and public debt for 2023-2025. Specifically, for 2023, it projects a public deficit of 3.8% of GDP, compared to the previously estimated 4.1%, and places public debt at 109.7% of GDP, in contrast to 111.1% in March.

For 2024, the estimated deficit is 3.4% of GDP (3.5% in its previous forecast) and the debt is 107.4% (previously 108.8%), while for 2025 it estimates a deficit of 4 % (4.4% previously) and a debt of 108% of GDP, better than the 109.9% projected last March.

Gavilán explained that this improvement in the forecasts for the deficit and the public debt are due to the review of the macro and financial environment. In any case, he has warned that the public sector will continue presenting in its projections until 2025 a "high fiscal imbalance".

The Bank of Spain points out that the fiscal assumptions of these projections incorporate the second leg of the pension reform, as well as the new aid to the primary sector and transport subsidies aimed at young people, which, according to their calculations, represent a "slight temporary deterioration" of the public balance of one tenth of GDP by 2023.

The institution's forecasts are also supported by previously approved measures, with the hypothesis that "a partial reversal of the upward surprises in tax revenues" that occurred in 2020 and 2021 will take place.

At this point, he explains that the progressive elimination of the measures due to the pandemic and inflation will have a positive effect on the public balance of close to one point of GDP in both 2023 and 2024. On the other hand, in 2025, the impact will be negative. , of four tenths of GDP, due to the end of taxes on energy and banking.