MADRID, 19 Sep. (EUROPA PRESS) -

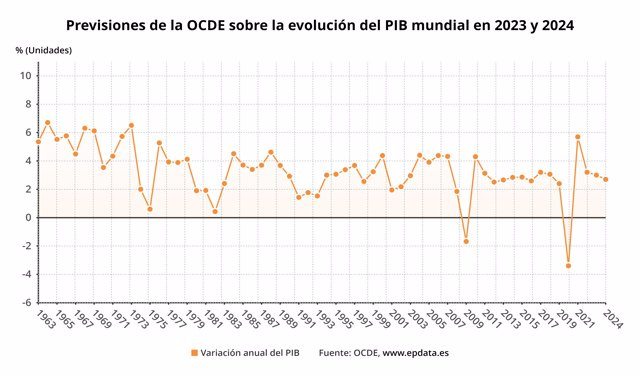

The Organization for Economic Cooperation and Development (OECD) has revised its growth forecast for the world economy in 2023 up three tenths, which now stands at 3%, although it has worsened its forecast of 2.7% by two tenths. for next year, as announced this Tuesday by the 'think tank' for the most advanced economies.

Among the main world economies, the new OECD projections contemplate greater growth in the United States, with an expansion of 2.2% this year and 1.3% the next, six and three tenths above June forecasts . The year-on-year slowdown is explained by the tightening of financial conditions, which will impact demand.

In the case of the euro zone, the Paris-based organization anticipates a GDP expansion of 0.6% in 2023, three tenths worse than previously expected, while it has dropped four tenths, to 1.1%, the projected growth for next year. The rebound is motivated by the "fading of the adverse impact of high inflation on real incomes."

Outside the OECD countries, the think tank's forecasts point to a worse evolution of the Chinese economy due to "weak" domestic demand and "structural stress" in the real estate market. Thus, GDP expansion will be 5.1% this year, compared to the 5.4% forecast in June, while there will be a growth of 4.6% in 2024, five tenths less.

Regarding emerging countries, Brazil has seen its 2023 growth revised by one and a half more, to 3.2% due to benign weather during the first half of the year that has boosted agricultural production. India and South Africa have also both seen their GDP estimates improved by three tenths, to 6.3% and 0.6%, respectively.

"Asian economies, particularly India, are expected to account for a considerable share of global growth in 2023 and 2024," explained OECD chief economist Clare Lombardelli.

RISKS TO DOWNWARD GROWTH

In any case, the OECD warns that growth continues to be below the historical average and that "the risks lean to the downside", pointing out as the main uncertainty the speed of transmission of monetary policy decisions and the "persistence of inflation".

"The adverse effects of high interest rates could be stronger than anticipated, and the persistence of inflation may require additional monetary tightening that could expose financial vulnerabilities," the OECD explained.

In this sense, the Paris-based organization has recommended that monetary policy remain "restrictive" until there are "clear signs" that underlying inflation has been controlled. The OECD has assured that interest rates "appear to be at or near their peak" in most countries, including the United States and the euro zone.

Similarly, OECD Secretary-General Mathias Cormann has noted that "it will probably be necessary to maintain them at or near current levels for several quarters" in order to control inflation.

Likewise, a stronger-than-expected slowdown in China adds "added risks" that would impact growth in the rest of the world. If there is a 3% year-on-year drop in domestic demand from the 'Asian giant', global GDP growth could be cut by up to six tenths in the first year and trade volume would do the same by 1.25%.

The impact on the GDP of the European countries of the OECD and North America would be a few tenths, with other Asian nations or those producing raw materials being mainly affected.

However, if a tightening of financing conditions were added to the previous circumstance, the impact would be greater; close to one point of GDP in developed countries. In this hypothetical case, the growth in global economic activity would be 1.1% lower, with the volume of goods and services declining by 2.75%. Consequently, the phenomenon would have a deflationary nature and would subtract four tenths from the expected price increase.

On the other hand, at the press conference to present the report, Lombardelli recalled that food and energy prices "are severely conditioned" by geopolitics and climate, so renewed volatility in these fields cannot be ruled out. .

Governments face growing fiscal pressures from rising debt due to aging populations, the ecological transition and rising defense spending. Regarding energy, Lombardelli has encouraged "cutting" the programs to combat inflation to limit it to "the most needy."

The OECD has argued that short-term efforts must be redoubled to rebuild credible medium-term fiscal plans that better align macroeconomic policies and ensure debt sustainability.

SOLUTIONS

In order to improve macroeconomic prospects, the OECD has recommended reducing barriers in the labor market and production; promote the development of knowledge and know-how to improve levels of investment, productivity and labor participation, as well as make growth "more inclusive."

The document also highlights the "primary" nature of international trade as an "important source of long-term prosperity for both advanced and emerging economies." According to the OECD, concerns about economic security should not prevent "taking advantage of opportunities" to reduce barriers to trade, especially in the services sector.

Likewise, the multilateral entity has encouraged governments to cooperate and coordinate in CO2 emission mitigation efforts.