The focus for investors today is on the US core PCE price index, a key inflation indicator. The broader markets are hoping for a break today after a tough week, but all eyes are on the upcoming US inflation data to see if the positive sentiment can be sustained.

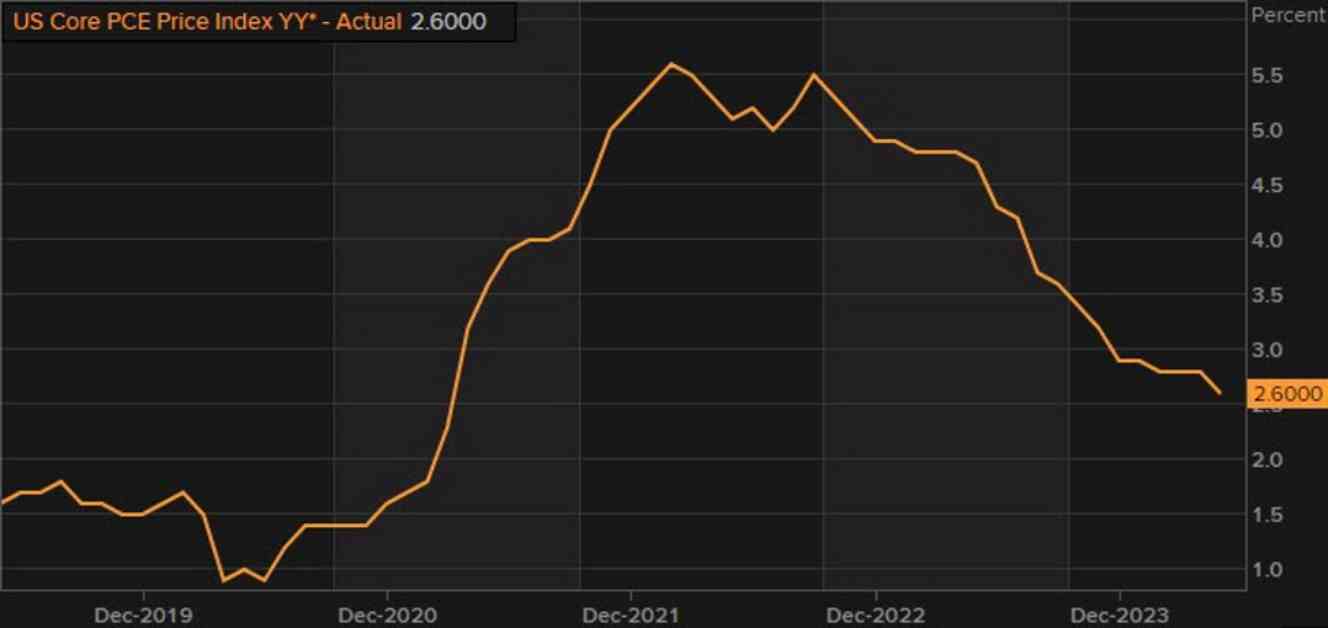

The expectations for the US PCE price index are for a monthly reading of +0.1% for both the headline and core estimates. The annual reading is anticipated to be at +2.5% for both the headline and core estimates. However, there are some experts, like Goldman Sachs, who predict a slightly higher core reading of +0.2% m/m and +2.6% y/y.

The current narrative suggests that the US is experiencing a gradual disinflation process. While this may not be a major setback for the Fed, any unexpected higher readings could rattle investors who are already on edge this week. The early gains in stocks and risk assets could quickly evaporate if the inflation data comes in above expectations.

It’s important to note that policymakers are prepared for potential bumps in the road as the disinflation process continues. Even if the core annual estimate reaches 2.6% today, it may not significantly alter the Fed’s outlook. However, in the current market climate, any surprises in the data could lead to increased volatility and uncertainty.

Investors will be closely monitoring the US core PCE price index data to gauge the inflationary pressures in the economy. The outcome of this report could have significant implications for market sentiment heading into the weekend. As always, it’s crucial for investors to stay informed and be prepared for any unexpected developments that may impact their portfolios.