AUD/USD procedures the monthly large (0.7805) since the US Dollar depreciates against all its major criteria, and the vital market themes may continue to keep the market rate afloat since the Greenback continues to represent a reverse connection with buyer confidence.

Subsequently, the pullback in the January high (0.7820) can prove to be an fatigue from the wider trend as opposed to an alteration in market behaviour as the Federal Reserve's balance sheet climbs into a new record high of $7.442 trillion at the week of February 10, along with new 2021 drops in AUD/USD will undermine the range for a double-top formation since the Federal Open Market Committee (FOMC) remains on course to"raise our holdings of Treasury securities by $80 billion each month and of bureau mortgage-backed securities by $40 billion each month."

At exactly the exact same period, the Reserve Bank of Australia (RBA) also seems to be about a preset route since the principal bank pledges to"buy an extra $100 billion of bonds issued by the Australian Government and states and territories when the present bond purchase plan is finished in mid April," and crucial marketplace themes may continue to affect AUD/USD before their next meeting on March 2 as the crowding behaviour from 2020 resurfaces.

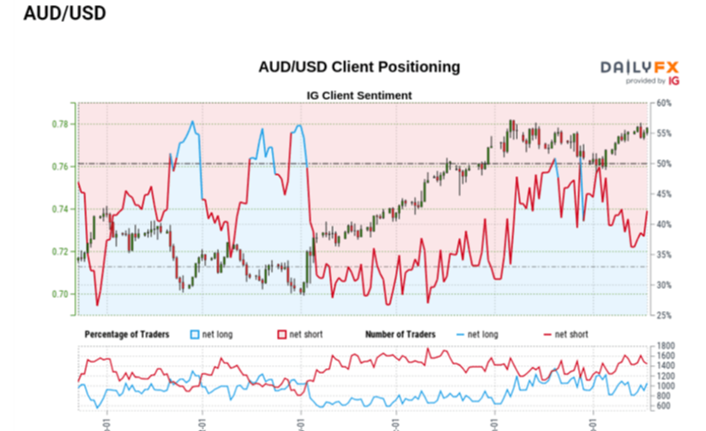

The IG Client Sentiment report reveals 39.44% of dealers are net-long AUD/USD, together with the proportion of traders brief to extended standing at 1.54 to 1.

The amount of dealers net-long is 1.77percent lower compared to yesterday and 2.25% reduced from a week, even while the amount of dealers net-short is 3.58% greater compared to yesterday and 8.69% reduced from last week. The drop in net-short place comes as AUD/USD pares the decrease from earlier this week, although the decrease in net-long standing has caused a further tilt in retail opinion as 40.09percent of dealers were net-long the set during the prior week.

That said, the pullback in the January high (0.7820) can prove to be an fatigue in the bullish price action as opposed to a change in fashion as crucial market themes stay in position, and looming advancements from the Relative Strength Indicator (RSI) can indicate a further appreciation in the exchange rate since the oscillator seems to be on track to extract the bearish tendencies from earlier this season.

Remember the AUD/USD correction in the September large (0.7414) was an exhaustion from the bullish trend as opposed to a change in behaviour as the market rate traded into new annual highs during December.

At precisely the exact same time, improvements in the Relative Strength Indicator (RSI)revealed the bullish momentum gathering speed as the index pushed to overbought territory for first time since September, using the rest above 70 accompanied with a further appreciation in AUD/USD such as the behaviour seen from the first half of 2020.

But a textbook RSI market sign emerged after the failed effort to check the March 2018 large (0.7916), together with AUD/USD trading to new 2021 lows in February since it neglected to conserve the January range.

But the pullback in the January high (0.7820) can prove to be an fatigue in the wider tendency as opposed to an increase in market behaviour involving the series of failed efforts to break/close under the 0.7560 (50% growth ) into 0.7580 (61.8% growth ) area, together with the RSI highlighting a comparable lively as the index begins to clear the bearish configurations from before this season.

Looming improvements from the RSI could indicate a further appreciation in AUD/USD when the oscillator has been apparent trendline resistance, using a movement over the January high (0.7820) bringing the 0.7890 (100% growth ) area on the radar.

The March 2018 large (0.7916) comes up next, which mostly coincides with the Fibonacci stride around 0.7930 (50 percent retracement) into 0.7950 (50% growth ).