The first stems in the Reserve Bank of Australia, which suddenly extended its authorities bond purchasing program. This was a relatively dovish shift for the central bank. Such measures tend to depress yields on bond yields on the front-end of the maturity spectrum. As soon as you start looking at the ones that are farther out, such as Australia's 10-year or 20-year pace, the reverse has actually been prevailing.

This has also been prevalent in closely-watched US Treasuries. In reality, the 30-year government bond return touched its highest since February 21, 2020. This could possibly be due to local financial stimulus expectations, which appear to be benefitting the Greenback.

President Joe Biden was pushing forward with trying to pass via a US$1.9 trillion Covid-relief package without Republican support through budget reconciliation. Last week's relatively disappointing local non-farm payrolls report undermined the case for more support. It's thus unsurprising to have seen the US Dollar give up some of its gains on the data, offering the Aussie a opportunity to recover some of its lost ground.

The week ahead is comparatively quieter, with the most widespread data from Australian business and consumer confidence. In the United States, the next inflation report and University of Michigan sentiment will cross the wires. This really is as vaccination rates are rising as daily Covid infections come in at slowing rates. On Wednesday, all eyes are on Fed Chair Jerome Powell where he hosts a webinar.

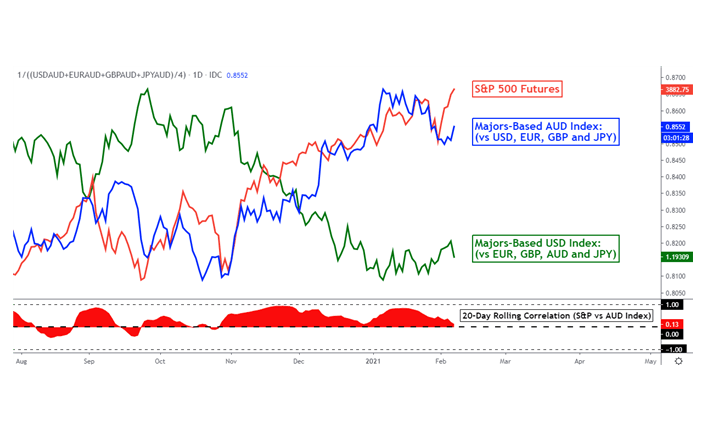

With that in mind, rising yields from the world's biggest economy will continue to offer some upside pressure for the Greenback as markets continue betting on a recovery. Thus, it could cancel some upside potential from the Australian Dollar if equities continue increasing.