Risk-sensitive Australian Dollar shifts higher on NFP overlook

Westpac customer confidence, US CPI responsible for second week

Traders weighing central monetary policy as projects, inflation skew outlook

Though the NFP print saw 559k occupations added for May, it was not enough to meet the +650k consensus prediction.

The jobs report culled rate hike bets causing bond dealers to buy US Treasuries. Yields fell in reaction and hauled the Greenback lower. While job gains were robust in the US economy every month, the missed print takes some sensed pressure off the Federal Reserve to tighten policy. Nevertheless, traders were invited to have some risk as the story shifts back to an easy-going central bank outlook.

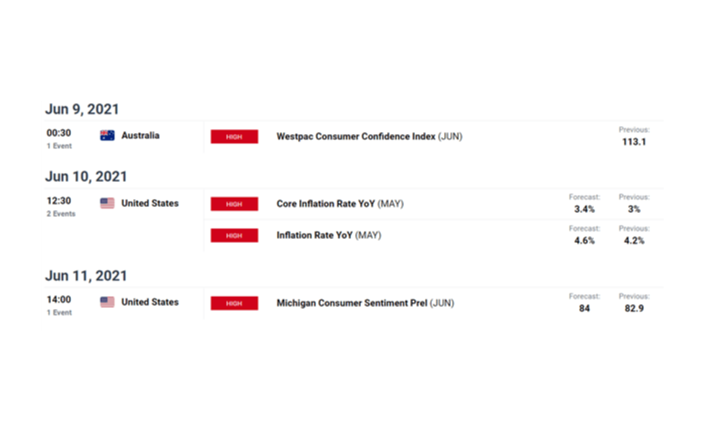

The Australian Dollar -- being a risk-sensitive currency -- rose against the majority of its major peers on Friday, a trend that may continue in the short-term, as the forthcoming week provides two key financial information prints. Wednesday will visit a national Westpac customer confidence report cross the wires for June, with the prior report demonstrating that a 113.1 figure, a decrease from April. The Reserve Bank of Australia (RBA) has held into its dovish tones concerning its coverage outlook, but a rise in the Westpac figure may boost hawkish calls and also the Australian Dollar with it.

Later in the week, the United States will release inflation information, which is the upcoming big economic print traders will soon be watching to judge opinion. Inflation pressures from the market have been front and centre in the markets, exacerbated by rising commodity prices. As stated by the DailyFX Economic Calendar, core inflation -- the Fed's favorite inflation metric -- is anticipated at 3.4percent for May. A strong print may raise hawkish calls and boost bond yields in response, which would likely lift the US Dollar and penalize the Australian Dollar.