ASIA-PACIFIC RECAP

Equity markets slipped lower throughout Asia-Pacific trade before a slew of corporate earnings releases from the US along with also the coming FOMC interest rate decision.

In FX markets, the cyclically-sensitive AUD and NOK largely outperformed alongside GBP, although the haven-linked USD, CHF and JPY dropped against their important counterparts. Gold cost drifted lower for the third successive day as returns on US 10-year Treasuries increased just under two basis points.

Looking forward, US durable goods orders for March emphasize the forthcoming economic docket, together with the launch of Tesla's much-anticipated earnings.

The US Dollar seems set to keep on drifting lower in the week beforehand, as investors turn their focus to the forthcoming Federal Open Market Committee's monetary policy meeting on Thursday.

Policymakers will probably not indicate any adjustments to the central bank's monetary policy position and therefore are anticipated to reiterate that there'll not be a tapering of steps until there's"considerable additional progress" towards its own mandated inflation and employment objectives.

That having been said, a very strong Q1 GDP printing could push longer-term minimal yields greater in the long run, and underpin the Greenback from its major counterparts.

But with prices economies winding back bets the Fed will grow out of the powerful lower bound in 2022, it appears relatively unlikely that a rancid data release will change the needle and activate a marked sell-off from Treasury markets.

Bearing that in mind, the haven-associated US Dollar will continue to go south in the forthcoming days, beyond a change in market sentiment towards a risk-off atmosphere.

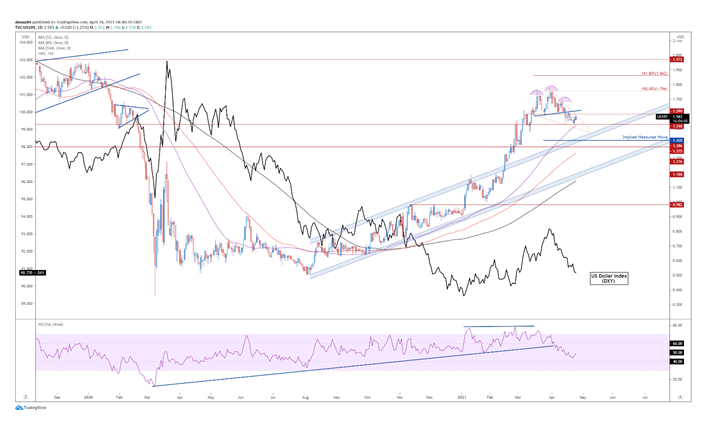

From a technical standpoint, the US Dollar seems set to keep on sinking lower against its major counterparts in the long run, since the DXY snaps back under all six moving averages and pieces through crucial psychological service at 91.00.

Together with the RSI diving under 40 for the first time since January, and the MACD slipping into negative territory, the route of least resistance appears skewed to the downside.

A daily close below array service at 90.63 -- 90.79 would probably reevaluate selling pressure and split a path to battle the annual non (89.21).

But if this remains intact a bounce back towards sentiment-defining 144-MA (91.55) may be on the cards.