It will "gradually" withdraw the reduction in taxes on electricity and gas, and maintain the reduction in VAT on food

MADRID, 27 Dic. (EUROPA PRESS) -

This Wednesday, the Government approved a new Royal Decree-Law on measures to address the effects of inflation, the energy crisis and the war in Ukraine, which includes the extension of the VAT reduction on basic foodstuffs, free Cercanías and the 50% reduction in regional transport.

The President of the Government, Pedro Sánchez, appeared at a press conference after the last Council of Ministers this year to explain this anti-crisis decree, a text that involves reductions in taxes and fiscal benefits of more than 2,500 million euros during the year 2024. .

Despite this deployment of resources, Sánchez has assured that the new package of measures "is contextualized in the Executive's commitment to fiscal consolidation." "The Government of Spain maintains its commitment to achieving a public deficit of 3% of GDP during the year 2024, and we have also marked a reduction in public debt to 106%," stressed the Chief Executive.

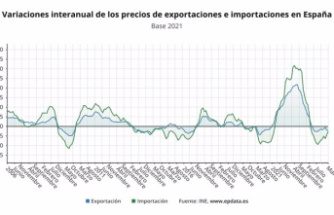

According to the Government, the evolution of the economy and prices has experienced improvements precisely in that last year, to which the royal decree laws approved by the Government have contributed, which have led to savings of more than 25,000 million euros for both citizens as well as for companies. However, the Executive has decided to promote a new package of measures with the extensions of some that came into force in 2022 or began in 2023.

Thus, in this next package of measures, the elimination of the 4% VAT that applies to all essential foodstuffs, including bread, flour, milk, cheese or eggs, and the reduction from 10% to 5% of oil and pasta.

For its part, the new package includes the prohibition of evictions of vulnerable people until 2025, the impossibility of suspending basic supplies, the maximum discount of the social bonus for vulnerable families or the limitation on increases in the price of the regulated gas rate. and the butane cylinder.

The Government has also extended again for the entire year 2024 the free Cercanías and Media Distancia trains for regular users, as well as the 50% discounts on regional transportation.

Likewise, companies that take advantage of measures to reduce working hours or suspend contracts regulated for reasons related to the invasion of Ukraine and that benefit from public support will not be able to justify objective layoffs based on the increase in energy costs until the next June 30th.

The Government has also extended for all of 2024 the measures by which bank commissions or compensation are eliminated for the early repayment of mortgage loans at a variable rate, the conversion of the loan to a fixed rate and free conversions from a variable to a mixed rate. .

Other measures that have been included in this decree are the revaluation of contributory pensions to 3.8%, the elimination of commissions for cash withdrawals at the counter for elderly and disabled people and the transfer of the management of the minimum vital income. for the autonomies that request it.

The President of the Government also announced this Wednesday the extension for one more year of the taxes on extraordinary profits of both the financial sector and the energy sector and has advanced the intention of making both taxes permanent.

The decree also extends the application of the Temporary Solidarity Tax on Large Fortunes until the review of property taxation in the Autonomous Communities takes place, a circumstance that, according to the Government, is linked to the reform of the regional financing system.

In the field of energy, the tax reduction on VAT on electricity consumed by households is maintained, although the VAT rate will go from the current 5% to 10% on all components of the electricity delivery bill. This measure will cover the entire year 2024.

The same 10% tax will be applied to the gas bill, a tax reduction that will be in effect from January 1 to March 31 of next year.

This type of VAT will also be applied to pellets, briquettes and firewood, ecological substitutes for natural gas from biomass and intended for heating systems. The period included to apply said reduction will cover January 1, 2024 and June 30 of that same year.

For its part, the Special Tax on Electricity will also maintain a reduction in its tax rate in the first half of 2024. During the first quarter of that year, the IEE rate will be set at 2.5%, while in the second quarter, this will go to 3.8%. This tax reached 5.113% before the Government began to promote measures.

Regarding the Tax on the Value of Energy Production, the Government has decided that it will have a rate of 3.5% until March, going to 5.25% until June

Likewise, all measures aimed at reforms that help achieve more sustainable energy consumption are extended until December 31, 2024, whether in private homes or in neighboring blocks.

These aid, linked to the Recovery, Transformation and Resilience Plan (PRTR), will allow those who promote these actions on their properties to deduct 20%, 40% or 60% of personal income tax.

Along with the above, it is necessary to highlight the extension in the freedom of amortization for those investments that use energy from renewable sources.

The Executive will allow the self-employed to apply the objective estimation method to calculate the net performance of their economic activity.

The exception is agricultural, livestock and forestry activities, which already have a quantitative limit per specific volume of income.