MADRID, 29 Dic. (EUROPA PRESS) -

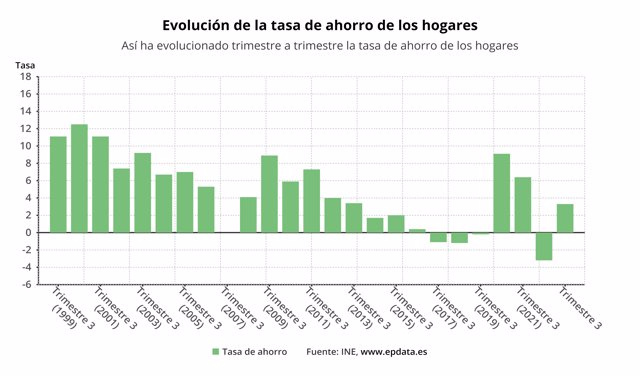

Spanish households placed their savings rate at 3.3% of their disposable income in the third quarter, compared to the negative rate of 2.3% that they experienced in the same period of 2022, as reported this Friday by the National Institute of Statistics (INE).

Between July and September, households spent less than they earned. Thus, its disposable income increased by 10.6% year-on-year, up to 210,846 million euros, while its consumption spending totaled 203,078 million euros, 4.5% more.

As a consequence of all this, households saved 7,027 million euros in the third quarter, compared to the negative amount of 4,338 million euros in the same period of 2022.

If seasonal and calendar effects are eliminated, the household savings rate reached 9.1% of their disposable income in the third quarter, a rate 2.8 points lower than that of the previous quarter.

Households were not able to finance with their savings the investment they made in the third quarter of the year, which amounted to 14,159 million (5.7%), so they showed a financing need of 7,691 million euros, compared to 18,313 million estimates for the same quarter of 2022.

THE ECONOMY HAS A FINANCING CAPACITY OF 3.8% OF GDP

The Spanish economy registered a financing capacity compared to the rest of the world of 13,670 million euros in the third quarter of 2023, which represents 3.8% of GDP for that period. In the same quarter of 2022, the financing capacity was 6,383 million (1.9% of GDP).

This increase is explained by a greater balance of foreign exchanges of goods and services (18,087 million euros, compared to 6,223 million in the same period of 2022) which, together with the evolution of income and current transfers, provides a balance of operations currents with foreign countries higher by 7,083 million than in the same quarter of the previous year. Likewise, the balance of capital transfers is 3,255 million, compared to 3,051 million in the same quarter of the previous year.

Likewise, the result is a consequence of the financing capacity recorded by public administrations, non-financial companies and financial institutions, in contrast to the need for financing shown by households.

In the case of public administrations, they showed a financing capacity of 9,935 million euros, compared to the capacity of 8,287 million that they presented in the third quarter of 2022.

Eliminating seasonal and calendar effects, Public Administrations record a financing need of 4.3% of GDP, six tenths less than in the previous quarter.

For their part, financial institutions recorded a financing capacity of 8,376 million euros, compared to 10,956 million in the third quarter of 2022, while non-financial companies showed a positive balance of 3,050 million euros, below the 5,453 million in the third quarter of 2022.

The INE estimates that the gross national income of the economy stood at 356,669 million euros in the third quarter, with a variation of 6.2% compared to the same period in 2022, while the gross disposable national income grew by 6.2%. 2%, up to 352,016 million.