The markets are now looking at the US CPI.

MADRID, 9 Abr. (EUROPA PRESS) -

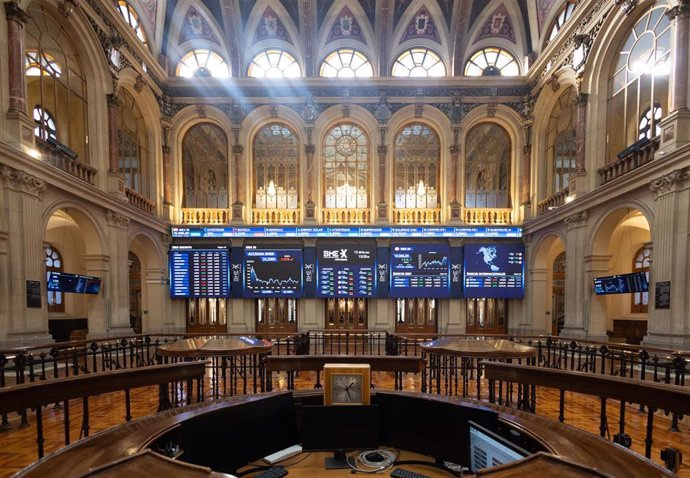

The Ibex 35 signed its third consecutive downward session this Tuesday by losing 0.88%, thus moving away from the level of 11,000 points - it ended at 10,816 points - in a day with few macroeconomic and business references, while that attention now moves to the United States inflation data in March, a reference that will be known tomorrow along with the latest minutes of the Federal Reserve (Fed).

The Spanish selective started the session lower, but managed to stabilize the losses at around 0.4%, slightly below 10,900 points; However, the declines have widened with the negative opening of Wall Street, whose indices were down half a percentage point at closing time in Europe.

In the business field, CriteriaCaixa, the holding company of the La Caixa Banking Foundation, announced on Monday that it has reached a 5.007% stake in Telefónica's shareholding.

In the debt markets, the Public Treasury has placed 5,231.93 million euros in short-term debt this Tuesday, in the expected medium-high range, and has done so by offering lower returns for 6-month bills and for 12 month letters.

Thus, investors' attention remains focused on the United States inflation data, which will be published tomorrow, and on the meeting of the European Central Bank (ECB) on Thursday. In both, investors will look for clues about the level of monetary policy for the summer.

Given this situation, Indra has posted the most bearish result on the Ibex with a fall of 3.16%, followed by Banco Sabadell (-3.13%), Mélia Hotels (-2.04%), Mapfre (-1.97 %), Logista (-1.95%), Unicaja (-1.85%), Repsol (-1.83%), Fluidra (-1.83%), Inditex (-1.8%), Banco Santander (-1.63%), BBVA (-1.6%) and Caixabank (-1.07%).

On the opposite side, Cellnex has been the most bullish value with a rise of 3.39%, followed by Colonial (1.86%), Endesa (1.68%), Enagás (1.42%), Acerinox (1 .35%) and Merlín Properties (1.24%).

Losses have been the common denominator among the European benchmark markets: London fell 0.11%; Paris 0.86%; Milan 1.08% and Frankfurt 1.32%.

At closing time in the Old Continent, a barrel of Brent fell 0.58%, to $89.86, while West Texas Intermediate (WTI) stood at $85.62, 0.93% less.

The yield on the Spanish bond maturing in ten years closed at 3.179% after subtracting seven basis points, with the risk premium (the differential with the German bond) at 81 points.

In the foreign exchange market, the euro depreciated 0.05% against the dollar, until trading at an exchange rate of 1.0855 'greenbacks' for each unit of the community currency.

For its part, the troy ounce of gold broke its all-time high this morning, standing at $2,365 - at the close of Europe it stood at $2,342 -, while bitcoin depreciated 3.66%, to $69,000. , after having touched $73,000 yesterday.