Only three values escape the 'red numbers', with the banks pressing downwards

MADRID, 5 Abr. (EUROPA PRESS) -

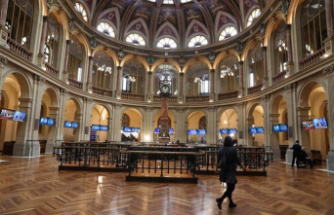

At midday this Friday, the Ibex 35 stabilized its opening losses at 1.5%, which has placed it at 10,921.3 points, awaiting release this afternoon of the United States employment report for March and on a day in which investors are watching Grifols and Talgo.

The Spanish selective, like the rest of Europe, has started the session with strong declines in line with those recorded yesterday by Wall Street -of more than 1%- and in Asia in the early morning -Tokyo gave up almost 2%-, in an environment of doubts about the next movements of the Federal Reserve (Fed) of the United States, since the market no longer waits with such determination for three reductions in interest rates to be undertaken in that country.

In this way, the selective lost the psychological level of 11,000 points at the opening, the maximum of 2017, with all its values in 'red' at the start of the trading day, although some components managed to move to the advances at noon.

Contrary to the rate situation in the United States, the minutes of the last meeting of the European Central Bank (ECB) published yesterday indicated that the arguments in favor of considering a reduction in interest rates were gaining more and more weight.

This divergence in interest rate outlooks between geographies translated into losses of almost 2% for the Euro Stoxx banking index.

On the European macroeconomic agenda this Friday, it was learned in Spain that the General Industrial Production Index (IPI) rose 4.1% in February compared to the same month in 2023, a rate one tenth higher than that of the previous month. and its highest year-on-year increase since March 2023, as reported by the National Institute of Statistics (INE).

For its part, new orders from German factories registered a monthly increase of 0.2% last February, after the 11.4% drop experienced in January, thus fueling the hope that the 'European locomotive' ' can avoid recession at the start of 2024, according to preliminary information from the Federal Statistics Office (Destatis).

In the business sphere, Grifols sent this Thursday – with the market already closed – to the National Securities Market Commission (CNMV) the information required by the supervisory body in which it revealed that it will proceed to reduce the number of measures to two. used to reflect Ebitda in its results communications and placed its net debt in 2023 at 10,527 million euros, with 1,111 million in leasing contracts.

At the same time, Magyar Vagon registered the request with the CNMV to acquire Talgo for 619 million euros, asking the Government for express authorization of this operation.

The Minister of Economy, Commerce and Business, Carlos Body, has announced that the Government will defend the "strategic interests" of Spain in the Public Acquisition Operation (OPA) that the Hungarian group Magyar Vagon has launched on Talgo for 619 million and that the Executive is already analyzing.

In addition, a consortium formed by Ferrovial, Acciona and Sacyr has been awarded the development of an urban highway in Lima (Peru) under the concession format for 3,400 million dollars (about 3,131 million euros), as reported this Friday by the three companies.

On the other hand, the board of directors of Grenergy will propose to the next general meeting of shareholders, which will be held on May 7 on first call, the appointment of David Ruiz de Andrés as executive president of the company and Pablo Otín as CEO .

Thus, in the middle section of the negotiation, only Grifols (1.63%), Endesa (0.35%) and Repsol (0.3%) recorded advances, while on the losses side BBVA stood out (-2, 76%), IAG (-2.7%), Mélia Hotels (-2.55%), Banco Santander (-2.46%), Amadeus (-2.43%) and Banco Sabadell (-2.07% ).

The main European stock markets also decidedly opted for declines at midday: London was down 0.9%; Paris 1.34%; Frankfurt 1.46% and Milan 1.54%.

At the same time, the price of a barrel of Brent quality oil, a reference for the Old Continent, rose 0.35%, to 90.95 dollars, while that of Texas stood at 86.7 dollars, a 0.15% more.

In the foreign exchange market, the price of the euro against the dollar advanced and remained unchanged at 1.0837 'greenbacks', while in the debt market the interest required on the ten-year Spanish bond climbed to 3.204% after add almost two basis points, with the risk premium (the differential with the German bond) at 83.5 points.