MADRID, 30 Ene. (EUROPA PRESS) -

The Ibex 35 registered an advance of 1.11% in the mid-session, reaching 10,000.1 points, driven above all by the banking sector on a day in which BBVA published its results account for the year 2023.

The bank chaired by Carlos Torres registered a record net attributable profit of 8,019 million euros between January and December 2023, 22% more in current euros compared to the previous year, excluding from the comparison the net impact of the purchase of offices from Merlin in Spain in 2022.

Likewise, it has announced the payment of a dividend of 0.39 euros gross per share, expected in April, as a complementary dividend for the year 2023. Thus, the bank will distribute to its shareholders a total of 0.55 euros per share charged to the 2023 results, after already giving 0.16 euros in October, which implies raising the dividend by 28% compared to the 0.43 euros that it distributed against the 2022 results.

Added to this is a new share buyback plan worth 781 million euros.

Regarding macro data, the INE reported this Tuesday that the gross domestic product (GDP) grew by 2.5% in 2023, one tenth more than expected. For its part, the consumer price index (CPI) rose three tenths in year-on-year rate in January, up to 3.4%.

In this context, towards mid-session, BBVA led the 35 stocks on the Spanish selective, advancing 4.86%. They were followed by Grifols (3.38%), Rovi (2.86%), Banco Santander (2.14%), Banco Sabadell (1.76%), CaixaBank (1.45%) and Ferrovial (0.96% ).

On the opposite side was Acciona Energía (-2.88%), ahead of Acciona (-1.81%), Acerinox (-1.76%), IAG (-1.31%), Bankinter (-1, 11%), Redeia (-1.08%) and Colonial (-1.05%).

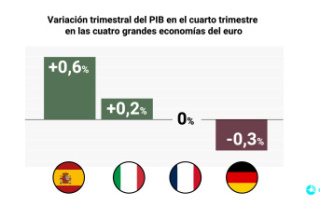

Regarding the rest of the main European markets, the evolution towards the mid-session was also positive. London advanced 0.56%; Paris, 0.44%; Frankfurt, 0.14%; and Milan, 0.48%.

A barrel of Brent stood at $82.42, 0.02% higher, while West Texas Intermediate (WTI) rose 0.22%, to $76.95.

In the debt market, the yield on the Spanish bond with a 10-year maturity advanced to 3.140%, from the 3.128% observed at the close of Monday. In this way, the risk premium against German debt remained unchanged at 89.3 basis points.

Regarding currencies, the euro remained practically stable against the dollar, registering an exchange rate in the markets of 1.0838 'greenbacks' for each unit of the community currency.