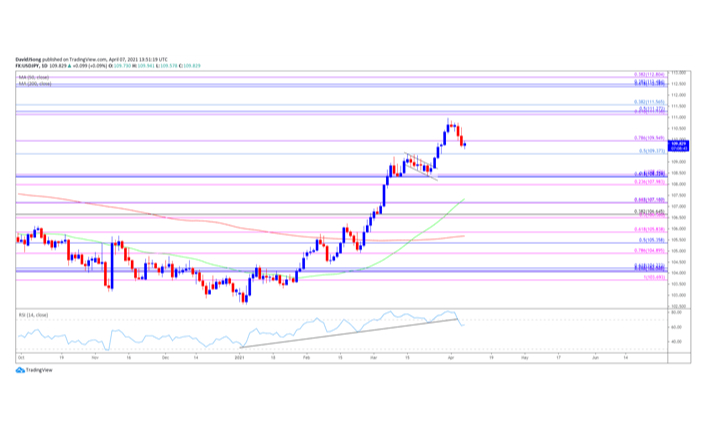

The USD/JPY rally unravels after the failed effort to check the March 2020 large (111.72), and current improvements from the Relative Strength Indicator (RSI) imply a further decrease in the market rate as the oscillator drops straight back from overbought territory to signify a textbook market sign.

USD/JPY extends the set of lower highs and highs from earlier this week to mostly track the pullback at longer-dated US Treasury yields, and the bearish cost chain may push the exchange rate towards prior immunity as it hunts for support.

It remains to be seen when the decrease from the March large (110.97) will prove for a correction or a change in vogue as a'gold cross' occurs in 2021, and also the wider rise in longer-dated Treasury yields will continue to keep the exchange rate payable because the above-forecast printing for US Non-Farm Payrolls (NFP) puts pressure on the Federal Reserve to scale back its crisis steps.

On the other hand, the Federal Open Market Committee (FOMC) seems to be in no hurry to change gears since the central back remains on course to"raise our holdings of Treasury securities at least $80 billion each month and of bureau mortgage-backed securities by $40 billion each month," along with also the minutes from the March meeting can indicate a dovish forward advice for financial policy as many Fed officials see the benchmark rate of interest siting near zero during 2023.

Subsequently, that the FOMC Minutes will keep USD/JPY under stress should Chairman Jerome Powell and Co. show a greater willingness to deal with increase longer-dated US Treasury through'Operation Twist,' but more of the same in the Fed will prop up the exchange rate as new data prints coming from the US market point to a stronger comeback.

Meanwhile, the recognition in USD/JPY has spurred a change in retail opinion as dealers reverse net-short for the second time this calendar year, together with all the IG Client Sentiment account revealing 43.85percent of dealers now net-long the set as the proportion of traders brief so extended at 1.28 to 1.

The amount of dealers net-long is 12.46% greater compared to yesterday and 10.09% higher from a week, whereas the amount of dealers net-short is 5.93percent lower compared to yesterday and 3.80% reduced from previous week. The development in net-long standing has helped to relieve the lean in retail opinion since 40.56%, although the decrease in net-short interest might be a use of gain taking behaviour as USD/JPY bounce straight by a brand new weekly reduced (109.58).

That said, the USD/JPY rally suggests a possible change in market behaviour amid the reverse in retail opinion, but recent advancements from the Relative Strength Indicator (RSI) imply a further decrease in the market rate as the oscillator falls straight back in overbought territory to snap the up trend established at the beginning of the year.

USD/JPY approaches pre-pandemic amounts as a'gold cross' materialized in March, using a bull flag formation unfolding during exactly the exact same interval since the exchange rate transactions into new yearly highs.

The Relative Strength Indicator (RSI) revealed a similar lively as the index climbed above 70 for the first time since February 2020, but recent improvements from the oscillator imply a further decline in the market rate as it drops back in overbought territory to snap the up trend established at the beginning of the year.

In turn, the USD/JPY rally unravels after the failed effort to check that the March 2020 large (111.72), with the latest string of lower highs and lows increasing the range for an evaluation of the prior resistance zone approximately 109.40 (50 percent retracement) into 110.00 (78.6% growth ).

Second area of interest comes from approximately 108.00 (23.6% growth ) into 108.40 (100% growth ) accompanied by the 107.20 (61.8% growth ) area, which mostly lines up with all the 50-Day SMA (107.34).

Yet, absence of momentum to close under the prior resistance zone approximately 109.40 (50 percent retracement) into 110.00 (78.6% growth ) may maintain the 111.10 (61.8% growth ) into 111.60 (38.2% retracement) place on the radar, together with another region of interest coming in approximately 112.40 (61.8% retracement) into 112.80 (38.2% growth ).