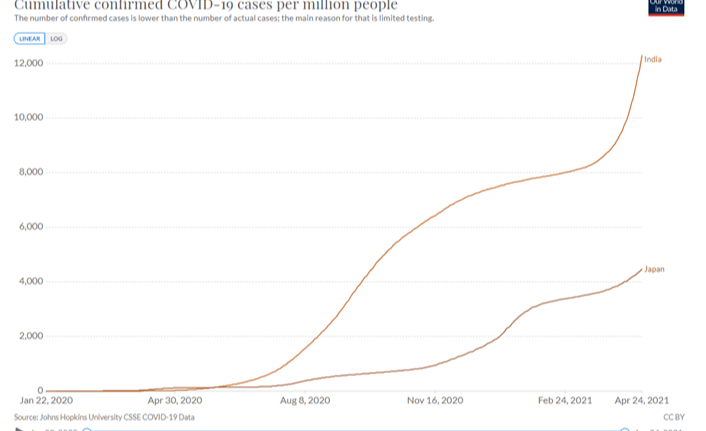

WTI traded marginally lower throughout the APAC mid-afternoon session because viral resurgence in Japan and India set a sour tone for petroleum trading. Japan announced a third country of crisis at Tokyo, Osaka and also two other prefectures to suppress a surge in coronavirus instances.

Japan is the world's fourth biggest oil importing country, absorbing approximately 7% of oil exports throughout 2019. Thus, reduced domestic travel and a block of high-income companies could bring a significant effect to energy intake during the limited period.

India reported that a record boost in its everyday Covid-19 infections, together with 349,691 cases additional within the previous 24 hours. A quick spike in coronavirus infections can result in tightened travel restrictions and may bring the nation closer to some nation-wide lockdown.

Meanwhile, oil dealers will continue to keep a watch on Wednesday's OPEC and non-OPEC ministerial meeting for hints about the distribution outlook. Ever since that time, the energy requirement prognosis was brightened by strong economic information in the united states and China. Looking forward, threatening viral scenarios in regions of Asia may hinder OPEC+ from contemplating increasing output farther.

Iranian oil production may be an additional wildcard in the petroleum industry. Lately, the country tried to restart talks about the 2015 atomic deal to be able to spare itself from economic sanctions imposed by the usa. Even though the continuing discussions have yet to yield some fruit, the possible yield of Iranian supply later on places a threat to this delicate supply and demand equilibrium.

Technically, WTI formed a"Double Top" blueprint before entering a consolidative stage on the 4-hour graph. A direct resistance level is located in US$ 63.83 - the 61.8% Fibonacci retracement. An immediate service level are discovered at approximately US$ 61.15 -- the 100-period SMA line.

The MACD indicator has shaped a bullish crossover underneath the neutral midpoint, indicating that bullish momentum might be collecting.