It points to a cumulative increase in rental prices of more than 28% between 2015 and 2022 and warns of the boom in vacation rentals

MADRID, 23 Abr. (EUROPA PRESS) -

The Bank of Spain assures that 600,000 homes are needed until 2025 to make up for the property deficit in the country, despite the fact that there are almost 4 million empty or unoccupied homes, according to data collected in its '2023 Annual Report'.

This housing deficit would be explained, among other reasons, by the lack of land to build and would be concentrated in five provinces of the country: Madrid, Barcelona, Valencia, Málaga and Alicante.

Other reasons that explain the lack of housing, according to the report, are the increase in construction costs, the shortage of qualified labor, the progressive aging of those employed in construction and the deficit in vocational training, as well as the shortage of investments aimed at the acquisition and promotion of new urban land.

Similarly, the organization chaired by Pablo Hernández de Cos points out that the lower 'stock' of available housing is due to the rise in vacation rentals in recent years, which already represents close to 10% of the size of the rental market and has a ratio estimated at 1.8% of the total number of main homes in the residential market, with some 340,000 homes.

During the presentation of the report, the general director of Economy and Statistics of the Bank of Spain, Ángel Gavilán, warned that "it is no longer possible to act" on this housing deficit, because the homes that will be built until 2025 "have already been announced ".

On the other hand, the study highlights that almost 4 million homes in Spain are empty or unoccupied. Of them, a good part are found in areas with less geographic dynamism - in cities with more than 250,000 inhabitants, empty homes would represent 400,000 units -, while a significant proportion are in poor condition and about 450,000 are part of the 'stock' of new unsold housing.

"Although the mobilization of these homes could contribute to increasing the supply, among them there is a significant proportion that are in poor condition, with poor accessibility or with very low energy efficiency, so their mobilization would require, in advance, a rehabilitation," the report emphasizes.

In relation to the rental market, an increase of 1.3 million homes in the rental stock is estimated since 2007, where young people under 30 years of age have almost doubled their presence since 2006, reaching almost 60% in 2022.

The other group that explains the rental boom in Spain is that of the population of foreign origin. Both groups are where households with lower income levels are concentrated.

In 2023, the communities with the greatest weight of rental homes are Madrid (23.7%), Catalonia (24.9%), the Canary Islands (28.5%) and the Balearic Islands (30.9%), compared to the average in Spain as a whole 18.7%.

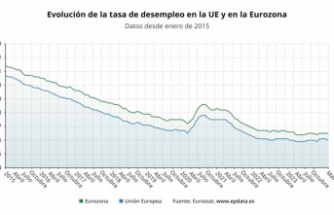

Regarding rental prices, between 2015 and 2022, the average accumulated increase in a rented home exceeded 28.5% due, above all, to the higher rental prices of new homes entering the market and the increases in prices in rented homes for which new contracts are agreed - between 7% and 8% more on average annually between 2015 and 2022 -.

According to data from the report, individuals represent 92% of home owners in the rental market, compared to 8% of private legal entities.

Furthermore, homes rented by private owners of more than 10 properties represent an estimated maximum of 7% of the entire market rental stock. On the other hand, the weight of social rental is very small in Spain, with an estimated figure of this type of housing of 300,000 units, 1.5% of main homes.

Regarding the acquisition of housing by the foreign population, both residents and non-residents, they have a very prominent weight, although heterogeneous by geographical areas, as highlighted in the report.

These transactions reached their historical maximum of 134,000 homes in 2022, a figure that decreased to around 125,000 in 2023, an amount that represents 19.3% of the total and contrasts with the 7.1% observed in 2007.

The highest proportions of foreign purchases are recorded in tourist areas, such as the islands and the Mediterranean coast, a circumstance that is explained by the high demand for second homes from non-resident citizens.

However, Gavilán has stressed that the majority of foreign sales are carried out by resident foreigners who have arrived in the economy in recent years, while the purchase of housing by non-resident foreigners only represents a figure close to 60,000 homes in recent years.

In the report, the Bank of Spain makes a series of recommendations to increase the 'stock' of housing, among which they highlight promoting the public housing stock, which would mean increasing the average annual production of housing registered by more than 150%. in Spain in recent years over the next 10 years to reach around 1.5 million new homes for social rental.

Likewise, it suggests promoting public-private collaboration for the promotion of rentals, by deepening the measures already approved to support the private sector, such as the transfer of public land, the granting of guarantees for the promotion of rental housing and Financing aid for the development of housing for social rent or at affordable prices.

Likewise, it calls for promoting the rehabilitation and transfer of homes, for which it demands to accelerate the absorption of 'Next Generation EU' funds, so that the housing rehabilitation ratios are in line with what is observed in the main economies and assess the suitability of establishing different mechanisms and incentives for the transfer of empty or sporadic-used homes to the public sector, so that they can be used for social rental.

In the fiscal area, the Bank of Spain suggests reviewing the taxation of housing to increase taxation on the recurring ownership of real estate, such as, for example, the Real Estate Tax (IBI), while reducing the rest of the taxes. taxes on the acquisition or production of housing to avoid excess taxation on this asset.

However, it points out that proposals that involve a reduction in taxes linked to the production and acquisition of housing should be proposed when the imbalances between supply and demand in the residential market are reduced because, otherwise, a significant part of the reduction in Taxes would be transferred in the form of an increase in the final price of the home, transferring public resources to the developers and owners of homes for sale.

In a more social area, it suggests improving public transportation in metropolitan areas, since the existence of a metropolitan public transportation network, combined with adequate urban transportation, would allow increasing the potential size of urban areas, increasing the benefits of agglomeration economies and reduce pressures on real estate prices.