It maintains the public deficit at 3.6% of GDP for 2024, and places it at 3.2% in 2025

MADRID, 13 Mar. (EUROPA PRESS) -

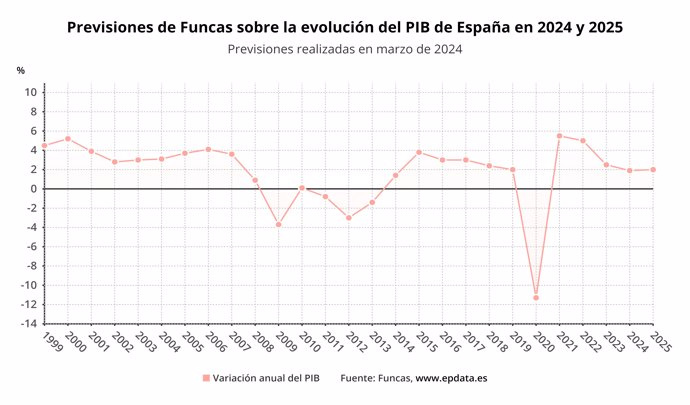

The Funcas Panel has revised upwards the forecast for the Spanish Gross Domestic Product (GDP) in 2024 from 1.6% to 1.9% and estimates an economic growth of 2% next year 2025.

This upward adjustment in the 2024 forecasts responds to the higher-than-expected GDP growth in the last quarter of 2023 - 0.6% compared to the estimate of 0.3% - and the positive results of the indicators in the start of this year. Thus, experts' estimates point to quarter-on-quarter growth rates of 0.4% throughout 2024.

The experts surveyed by Funcas improve both the forecast for national demand, especially for public consumption, and the contribution of the foreign sector, which goes from negative to zero, while Gross Fixed Capital Formation has been revised downwards.

By 2025 - this Panel includes forecasts for next year for the first time - the consensus expects GDP growth of 2%. The acceleration compared to 2024 would come from Gross Fixed Capital Formation and the increase in the contribution of the foreign sector, which would be 0.2 percentage points, while public consumption would slow down significantly. The quarterly GDP growth rates next year would be 0.5%.

After the slowdown in the inflation rate in February, largely due to the fall in the price of electricity due to the weather, the panelists expect the rate to move upward again in the coming months.

The average annual rate for the general rate would remain at 3% (unchanged from the previous forecast) and 3.1% for the underlying rate (one tenth more).

In 2025, the inflation rate will still remain above 2%, since forecasts place it at 2.3% and 2.5% for the general and underlying rates, respectively.

Regarding the labor market, experts consider that it continues to show strength at the beginning of the year. The panelists have revised upward the employment growth forecast for 2024 by five tenths, to 2%. By 2025, a slowdown is expected to 1.8%.

Regarding the average annual unemployment rate, the Funcas Panel estimates that it will be 11.6% this year and 11.2% next year.

Regarding the public accounts, the panelists maintain the public deficit forecast at 3.6% of GDP for 2024, and place it at 3.2% in 2025, that is, it would not fall below 3% in the period of forecast.

Thus, like other organizations such as the Bank of Spain, the Funcas Panel does not believe that the Government can meet its forecast of reducing the deficit to 3% this year 2024 and thus comply with European fiscal rules.

Experts warn that, in an environment that remains unfavorable - global uncertainties, war conflicts and the restrictive effect of interest rate increases - everything indicates that the ECB will maintain rates at least until June.

Analysts predict a first cut that month, followed by two additional cuts, which would bring the deposit facility to around 3.25% at the end of the year, unchanged from the January estimate. Market interest rates would follow a less pronounced trend. The Euribor would still stand at 3.2% at the end of this year and at 2.75% at the end of 2025.