MADRID, Feb. 27 (EUROPA PRESS) - Naturgy obtained a net profit of 1,986 million euros in 2023, which represents an increase of 20.4% compared to the profits of 1,649 million the previous year, in a year in which which boosted its investments to 2,944 million euros, 53% more, the company reported.

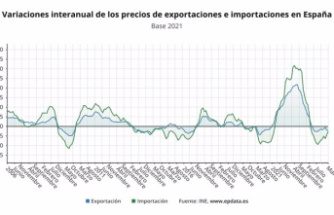

The gross operating result (Ebitda) of the energy company chaired by Francisco Reynés reached 5,475 million euros in 2023, 10.5% more, maintaining a balanced Ebitda mix between regulated and liberalized activities, which represented approximately 47% and 53% of the consolidated Ebitda respectively, in a year marked by the decline in energy prices and a scenario of great volatility.

For its part, the net amount of the turnover for fiscal year 2023 amounted to 22,617 million euros, 33.4% less than the previous year, mainly as a result of the exceptionally high energy prices in 2022, mainly caused by the beginning of the conflict in Ukraine after the invasion of Russia.

The company's net debt stood at 12,090 million euros at the end of 2023, in line with the levels at the end of 2022. The net debt to Ebitda ratio was reduced from 2.4 times at the end of 2022 to 2.2 times.

In addition, Naturgy maintains a significant liquidity cushion, with 9.2 billion euros in cash and equivalents and undrawn lines of credit at the end of last year.

ACHIEVE GOALS.

In this way, the company has beaten its 'guidance' in terms of Ebitda and net debt, while meeting its dividend commitment and the objectives of its investment plan for 2023.

Naturgy, the first gas company and the third largest electricity company in the country, highlighted that these solid results and cash generation "supported the significant increase in investments, while the dividend commitment was met and net debt levels remained stable."

"The good results for 2023 reflect, once again, the commitment, professional quality and good performance of the entire Naturgy team, as well as the solidity of our industrial growth plans and prudent financial management. We work every day to adapt this company, which has celebrated 180 years of life, to a new environment: that of transforming our business mix and contributing positively to the challenges of the energy transition in the countries in which we operate; especially, in Spain," said Reynés. .

The investment figure of almost 3,000 million euros from last year includes organic 'capex' of 2,136 million euros and M operations.

1 GW NEW IN RENEWABLES, TO REACH 6.5 GW.

In renewables, the group's installed capacity increased by 1 gigawatt (GW) during 2023, reaching a total capacity of 6.5 GW. The company continued to grow, within its strategy, in Spain, Australia and the United States.

In Spain, capacity increased by 575 MW, through the commissioning of new capacity and the integration of ASR wind (422 MW). In Australia, wind capacity increased by 109 MW along with 10 MW of battery storage.

Meanwhile, in the United States, the 7V Solar Ranch plant, located in Texas, began its test operations. With 300 MW, it is the largest solar plant that the firm has built and represents an important milestone for the company.

In addition, Naturgy expects its growth in renewable energy to accelerate in the coming years, with up to 1.2 GW and 2.3 GW of additional capacity coming into operation in 2024 and 2025, respectively.

Likewise, the group continued its strategic commitment to renewable gases in Spain, with more than 70 biomethane and hydrogen projects in different phases of development.

DIVIDEND OF 0.4 EUROS PER TITLE.

With regard to remuneration to its shareholders, Naturgy has agreed to propose to its next general meeting of shareholders, called for April 2, the payment of a complementary dividend of 0.40 euros per share, in line with the 1, 40 euros per title committed for this year, after the decision agreed last July to increase remuneration.

From the beginning of the 2021-2025 Plan until the end of last year, the energy company has generated a total aggregate Ebitda of 13,958 million euros, has invested 6,430 million, will have distributed a total of 3,908 million euros in dividends among its shareholders and will have contributed with 3,177 million euros, between taxes and taxes.

ASPIRE INVESTMENTS OF ABOUT 3,000 MILLION IN 2024.

Regarding future prospects, as it did in 2023, Naturgy is not currently quantifying its results objectives for 2024 due to "the extreme volatility of the energy markets and the unexpected weather."

However, it hopes to repeat the investment level of around 3,000 million euros in 2024, focusing on renewables, and maintain its prudent financial policy, which will allow it to return the dividend to the current level of 1.4 euros per share. .

To this end, the company has set management priorities for the current year, which include, among others, maintaining the investment commitment to the energy transition, mainly in Spain, with a special focus on renewable electricity generation and the development of renewable gases, as well as in the reinforcement of all its distribution networks; and regulatory management and management of natural gas supplies and supply contracts, with the aim of ensuring energy supply and competitiveness.