MADRID, 11 Abr. (EUROPA PRESS) -

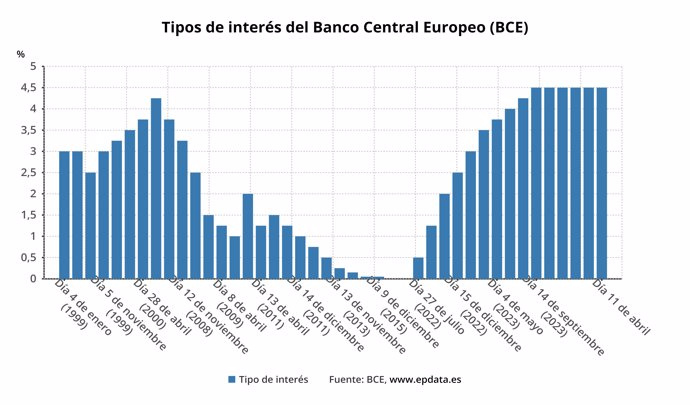

The Governing Council of the European Central Bank (ECB) decided this Thursday to keep interest rates unchanged, so that the reference rate for its refinancing operations will remain at 4.50%, while the deposit rate will remain at 4% and the loan facility at 4.75%.

In this way, the issuing institute leaves rates intact for the fifth consecutive meeting since it stepped on the brakes at its October meeting, after undertaking ten consecutive increases in the price of money, which placed it at its highest level in more than 20 years.

The ECB has stated that interest rates "are at levels that are contributing significantly to the ongoing disinflation process," although it has indicated that domestic inflationary pressures are "intense" and keep the prices of services "high." ".

"Inflation has continued to decline thanks to lower food and goods prices. Most indicators of core inflation are declining, wage growth is gradually moderating and businesses are absorbing some of the increase." of labor costs in their profits", the ECB has summarized.

The 'guardian of the euro' had raised rates by 450 basis points during the hike cycle that began in July 2022, although now the markets are betting that the ECB will lower the reference rate in the summer.

The ECB will continue to apply "a data-driven approach" to determining the appropriate level of tightening and duration of monetary policy, although it has warned that decisions will be made on a meeting-by-meeting basis, "without committing in advance to a specific path of monetary policy." guys".

In any case, the Governing Council has also advanced that it could be "appropriate" to reduce the current level of restriction if the prospects for general and underlying inflation, as well as the intensity of the transmission of monetary policy, "reinforce to a greater extent its confidence that inflation is converging toward the [2%] target on a sustained basis."

Regarding the asset purchase programs (APP) and the pandemic emergency purchase program (PEPP), the ECB has indicated that the former continues to be reduced at a "measured and predictable" pace, given that it has stopped reinvest the principal of maturing securities.

In the case of the second, the Eurosystem will continue to reinvest in full during the first half of 2024 the principal of the acquired amount that matures. Already in the second half of the year, the PEPP portfolio will be reduced by 7.5 billion euros per month on average to end reinvestments at the end of 2024.

CURRENT MACRO CONTEXT

The ECB's decision comes after the year-on-year inflation rate in the euro zone was 2.4% in March, two tenths below the price increase registered in the previous month. By excluding the impact of energy, food, alcohol and tobacco from the calculation, the underlying rate also moderated two tenths, to 2.9%.

In addition, Eurostat confirmed that the eurozone's GDP avoided recession after registering stagnation in the fourth quarter compared to the previous three months, when it contracted 0.1%.

In the case of the large economies of the EU, Germany registered a contraction of 0.3% in the fourth quarter, after stagnating between July and September, while France barely grew 0.1%, after the paralysis of the third quarter, and Italy maintained its expansion of 0.2%. In this way, Spain, with an expansion of 0.6% from 0.4%, once again became the large economy with the best evolution of the Twenty-seven.

The performance of the eurozone economy between October and December was significantly worse than that observed in the United States, where GDP increased by 0.8% quarterly, although it was more positive than the performance of the United Kingdom, which entered a technical recession after lose 0.3% in the last quarter of 2024 and drop 0.1% during the third.