MADRID, 29 Dic. (EUROPA PRESS) -

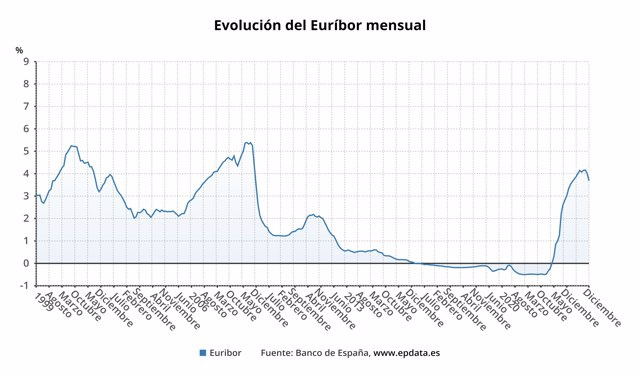

The 12-month Euribor, the index to which the majority of variable mortgages in Spain are referenced, closed December at 3.679%, registering its largest monthly drop since February 2009, according to data compiled by Europa Press and in the absence of confirmation from the Bank of Spain.

Compared to November, when it closed with a monthly average of 4.022%, the index has fallen by 0.34 points, compared to the reduction recorded in February 2009 of 0.48 percentage points.

Furthermore, the December data represents a return to the lowest levels since last March, when the Euribor closed at 3.647%. However, it is still above the level with which it ended 2022 of 3.018%.

In its daily rate, the index has already stood at 3.513%, its lowest level since March 27, when it stood at 3.469%.

The December Euribor level implies that a person who has contracted a variable mortgage of 150,000 euros with a residual maturity period of 30 years and with a differential of 0.99% plus Euribor and must review their interest rate in the month of November, you will register an increase in your mortgage payment of about 295 euros per month.

This calculation implies the maximum level of increase for a person who has contracted a mortgage with that financed level, since since it is a review at the beginning of the loan (that is, there are 30 years left to amortize), the change in the type of Interest has much more impact as there is a lot of principal to amortize.

From iAhorro they point out that this is "very good news" for mortgage holders, since after more than a year of almost continuous increases, a downward trend change in the Euribor is confirmed.

"This indicator, which since it returned to positive levels in April 2022, has recorded inter-monthly increases of up to one percentage point, has broken downwards this December the 4% barrier that it reached six months ago, in June, 4.007%," says the mortgage comparator. Furthermore, it stands out that the month-on-month drop, of more than three tenths, is the highest in 14 years, since February 2009.

However, the Mortgage Director of the mortgage comparator and advisor iAhorro, Simone Colombelli, warns that "we must be cautious" and "not 'go up' too quickly" because he sees it likely that the Euribor will remain around 3%. several months before continuing its decline.

Of course, the spokesperson for iAhorro admits that "this drastic drop in a single month has taken everyone by surprise." "We expected a drop, but not that much, but rather some drop that would be little by little, placing the Euribor in this area of 3.5-3.7%," although he adds that "this downward rate cannot be maintained over time and "We cannot yet rule out that there may be another increase, even if it is minimal, to adjust the levels of this indicator to around 3%."

iAhorro indicates that for the Euribor to continue falling it is "important" that the European Central Bank (ECB) reduces official interest rates, something that "has not happened so far."

For her part, Kelisto spokesperson Estefanía González points out that with "very controlled" inflation in the eurozone and an ECB "that not only rules out increases or maintenance of rates, but openly recognizes that reductions will arrive in 2024," The markets consolidate their forecasts from a few weeks ago, "taking the Euribor downwards at a frenetic pace."

"Despite this, the Euribor is rising again compared to December of last year, which continues without giving respite to variable mortgages with annual review that are reviewed in January. The good news will come, of course, for those who have a review semi-annual, which will see decreases in their quotas, since six months ago the Euribor was still above 4%," highlights González.

For the coming months, Kelisto's spokesperson considers "increasingly clear", and if there are no surprises with inflation, the progress of the economy in the eurozone and the plans of other central banks, "that rate cuts will come in the first half of the year", although the "big unknown" is whether there will be a decline at the gates of summer or at the end of the first quarter of the new year.

XTB analyst Manuel Pinto believes that the Euribor will continue to fall in the coming weeks, thanks to the downward trend in inflation, derived from lower demand, and the future decisions of central banks, in order to stimulate the economy.

In this context, and following the evolution of the Euribor in other periods of "important" cuts such as in 2000 and 2008, Pinto sees it possible that the reference interest rate will fall to levels close to 2% throughout the year.

"While the ECB does not dare to predict the number of rate cuts or the dates, the market is currently discounting that rates will drop 150 basis points and that the first cut could come in April," he explains.

Finally, Asufin predicts that the Euribor for the month of March 2024 can already be at 3.30%, while in June it would be at 3.00% and in September, at 2.80%. By the end of 2024, the index would end at 2.60%.