MADRID, 13 Sep. (EUROPA PRESS) -

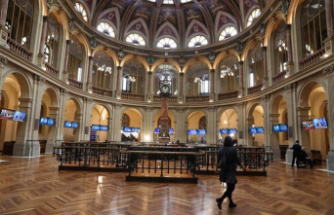

The Ibex 35 registered a decrease of 1.11% towards the mid-session, standing at 9,349.90 points, and with investors' attention focused on how the ECB will react tomorrow and on the inflation data that will be published this Wednesday of the United States, which will offer clues about the Federal Reserve's actions next week.

This Wednesday it was learned that the United Kingdom economy fell 0.5% in July compared to the previous month, weighed down by its three main economic sectors, especially services, a figure that contrasts with the 0.5% growth recorded by the second largest economy in Europe last June.

On the falls side, Aena (-3.47%), Inditex (-3.3%), which has presented results, Grifols (-3.2%), Redeia (-2.17%), Ferrovial (- -1.6%) and Iberdrola (-1.31%).

Inditex's decline occurs despite having published record semi-annual results, above analysts' forecasts.

Specifically, the firm founded by Amancio Ortega registered a net profit of 2,513 million euros during the first half of its 2023-2024 fiscal year (between February 1 and July 31), which represents an increase of 40, 1% compared to the same period a year before, while sales grew by 13.5% and reached 16,851 million euros.

On the contrary, only Solaria Energía (1.98%), Indra (0.66%), Banco Sabadell (0.47%), Repsol (0.26%), Banco Santander (0.23%) managed to advance. BBVA (0.08%) and Mélia Hotels (0.06%).

Regarding the rest of the main European markets, all were trading negative towards the mid-session. London fell 0.25; Paris, 0.66%; Frankfurt, 0.73%; and Milan, 0.92%.

For its part, a barrel of Brent was trading at $92.54 in the mid-session, up 0.52%, while West Texas Intermediate experienced an increase of 0.53%, to $89.31.

In the debt market, the yield on the Spanish bond with a 10-year maturity rose to 3.749%, compared to the 3.698% at which it closed on Tuesday. In this way, the risk premium against German debt rose by 1.2 points, to 106.7 basis points.

In the foreign exchange market, the euro depreciated 0.18% against the dollar, reaching an exchange rate of 1.0735 dollars for each euro.