MADRID, 30 Oct. (EUROPA PRESS) -

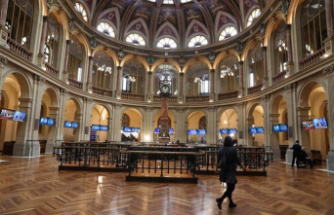

The Ibex 35 ended this Monday's session with an increase of 1.07%, which means that the selective of the Spanish stock markets and markets has closed at 9,013.9 points in a day marked by the presentation of business results, the uncertainty about the consequences of the conflict between Israel and Hamas and the publication of the advanced CPI in Spain.

Before the start of the trading day, Unicaja Banco informed the National Securities Market Commission (CNMV) that it closed the first nine months of this year with an attributed net profit of 285 million euros, which is equivalent to an increase of 4.9% compared to the same period of the previous year.

Also in the business sphere, ArcelorMittal reported an agreement in principle for the nationalization of its operations in Kazakhstan after the fire that broke out last Saturday in a mine, which has resulted in the death of at least 45 workers, according to local press reports. .

Regarding the macro agenda, this Monday the INE published that the Consumer Price Index (CPI) increased 0.3% in October in relation to the previous month and kept its interannual rate unchanged at 3.5%, due because the rise in electricity prices was offset by lower fuel prices and a less "intense" rise in food prices compared to that experienced a year earlier. Core inflation, for its part, moderated six tenths, to 5.2%.

Furthermore, this day it was learned that the economic confidence of the eurozone worsened again in October, accumulating six consecutive months of decline, which is why it has been at its lowest level for almost three years, although in the case of Spain the data has experienced the largest rise among the large economies of the eurozone.

On the other hand, Germany's gross domestic product (GDP) recorded a contraction of 0.1% between July and September, after the 0.1% expansion in the second quarter, whose reading has been revised up one tenth by the Federal Statistics Office (Destatis), while the advanced inflation in October of the German country will be known at 2:00 p.m. this Monday (a drop of five tenths is expected, up to 4%).

In this context, only three values have closed the session in 'red': ArcelorMittal (-3.98%), Unicaja Banco (-3.28%) and Acerinox (-0.11%).

On the opposite side, Sabadell led the bullish values, with 3.81%, while Santander advanced 2.54%; Meliá, 1.74%; Mapfre, 1.63%; and Rovi, 1.62%.

The rest of the main European stock markets have also had a positive evolution this Monday. London closed with 0.50%; Paris, with 0.44%; Frankfurt, with 0.20%; and Milan, with 0.19%.

Regarding the raw materials market, a barrel of Brent stood at $87.75 at the close of the trading session, 3.01% less, while West Texas Intermediate (WTI) reached $82.48, a 3.60% less.

In the debt market, the yield on the Spanish bond with a 10-year maturity closed the session at 3.894%, compared to the 3.927% observed at the close of Friday.

In the currency market, the euro appreciated 0.41% against the dollar at the end of the European trading session, up to 1.0609 'greenbacks' for each unit of the community currency.