What's CPI AND WHY DOES IT MATTER TO FOREX TRADERS?

The Consumer Price Index, much better known by the acronym CPI, is an increasingly important economic index released on a regular basis by significant economies to provide a timely glimpse into present increase and inflation levels.

Inflation tracked through CPI looks especially at purchasing power and the increase of prices of goods and services in an economy, which can be employed to affect a country's monetary policy.

CPI is calculated by averaging price changes for each item in a predetermined basket of consumer goods, including food, energy, and services such as medical care.

It is a useful indicator for forex traders because of the aforementioned effect on financial policy and, in turn, interest rates, which have an immediate impact on money strength. The full utility of knowing how to translate CPI as a foreign exchange trader will be explored below.

CPI RELEASE DATES

CPI release dates generally occur each month, but in a few states, such as New Zealand and Australia, quarterly. Some countries also supply yearly results, for example Germany's index. The US Bureau of Labor Statistics has reported the CPI yearly since 1913.

The next table shows a selection of major economies and data about their CPI releases.

WHY FOREX TRADERS SHOULD FOLLOW CPI DATA

Understanding CPI data is important to forex traders because it is a solid measure of inflation, which then has a significant impact on central bank monetary policy.

Just just how does CPI impact the economy? Frequently, higher inflation will interpret to higher grade interest levels being set by policymakers, to help dampen the market and subdue the inflationary trend. Subsequently, the higher a country's interest rate, the more likely its currency will strengthen. Conversely, countries with reduced interest rates frequently mean weaker currencies.

The launch and revision of CPI figures can produce swings in a currency's value against other currencies, meaning possibly positive volatility by which skilled traders may benefit.

Additionally, CPI information is frequently considered a useful indicator of the power of the financial policy of governments in response to the condition of their domestic market, a element that forex traders can consider when analyzing the likelihood of currency movements.

The CPI can also be utilized together with other indicators, like the Producer Price Index, for forex traders to acquire a clearer picture of inflationary pressures.

When using CPI data to influence forex trading decisions, traders should think about the market expectations for inflation and what is very likely to occur to the money if those expectations are met, or if they are missed.

Very similar to any significant release, it could be beneficial to avoid having an open position immediately before. Traders may consider waiting for several minutes after the launch before searching for possible trades, since forex spreads could expand significantly right before and after the report.

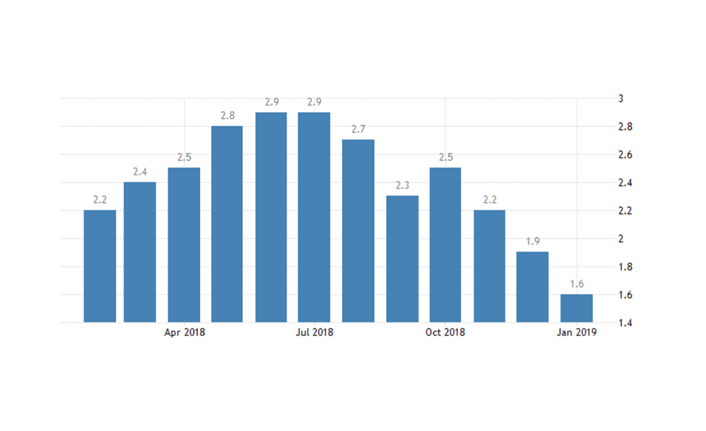

Below is a graph displaying the monthly inflation rates for the United States. For the latest month, expectations have been set at 1.6% inflation compared to previous year's data. If CPI is released lower or higher compared to expectations this information event does have the ability to influence the marketplace.

1 way the effects of CPI data can be translated is by tracking the US Dollar Index, a 2018/19 example chart for which is under. If CPI is released away from expectations, then it's reasonable to believe this might be the catalyst to induce the Indicator to new highs, or even to rebound from immunity.

Since the Index is comprised of EUR/USD, USD/JPY, and GBP/USD, by watching the US Dollar we could find a whole interpretation of those events result.