Money volatility, frequently quantified by calculating the standard deviation or variance of money price moves, provides traders an notion of just how much a money could move relative to its average over a particular time period. Dealers may also gauge volatility by simply taking a look at a currency set's average true selection or by taking a look at range as percentage of place.

The greater the degree of currency volatility, the greater the amount of danger, and vice versa. Volatility and risk are often utilized as synonymous terms.Different currency pairs have various degrees of volatility normally.

Some traders appreciate the greater potential rewards that have trading currency pairs that are volatile. Although, this increased potential benefit does pose a greater danger, so dealers should look at decreasing their position sizes when trading exceptionally volatile currency pairs.

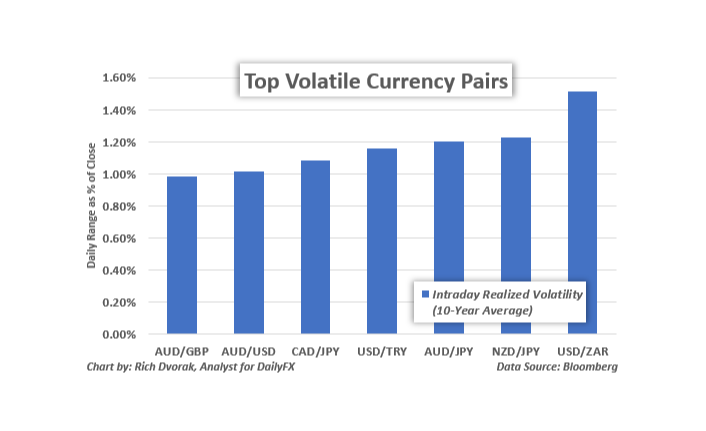

The most volatile Significant currency pairs are:

Other significant currency pairs, such as EUR/USD, USD/JPY, GBP/USD and USD/CHFare usually more liquid and less volatile as a outcome. Nevertheless, emerging market currency pairs, for example USD/ZAR, USD/TRY and USD/MXN, can clock a number of the maximum volatility readings.

Emerging Trade - USD/ZAR, USD/TRY, USD/MXN

Besides comparatively low liquidity, emerging market currencies are normally extremely volatile specifically because of inherent danger underpinning emerging market economies. The graph below provides an illustration of how volatile emerging market currencies could be, which reveals USD/ZAR (US Dollar/South Africa Rand) exploding almost 25% greater in just over a month. There are numerous different cases of emerging market currency pairs swinging radically similar to this throughout history.

The most volatile currency pairs are normally the significant currency pairs that are also the very liquid. Additionally, these savings are normally bigger and more developed. This brings more trading volume and eases better price stability consequently. To the end, contemplating EUR/USD, USD/CHF and EUR/GBP commerce with large volumes of money, it comes as little surprise they're one of the rental volatile currency pairs.

Illustrated below, the average true range (ATR) on USD/CHF ranges between 45-pips and 65-pips, a reduced average true range in contrast to other monies. The average true assortment of a money is among many means to assess the volatility of a currency pair. Bollinger Band width is just another popular technical index utilized to measure volatility.