- Although the Dollar finished the first half 2021 strong, the fundamental backdrop will make it difficult to encourage this recovery.

- If the Fed succeeds in keeping the Greenback under control, then there may be some anti-USD potential for pairs such as USDCAD in a high timeframe.

- The US central bank is not the only one reversing the extreme accommodation. That collective rise in yield forecasts is a threat Gold's high perch

The past quarter's preferred setups (range USD/JPY, long USD/CNH), failed to work as the Dollar couldn't gain meaningful momentum on a more hawkish outlook in its own monetary policy. The Federal Reserve appears to be moving towards normalization - tightening, but starting from a very accommodative point - in second half of this year. The efforts to acclimate markets and the release of the taper schedule can cause some difficulties in trading the Greenback. This is a key theme for this quarter's markets and my preferred setups include this type of current. This is the technical picture of USD/ CAD, with the Bank of Canada poised to make policy and Gold's exposure for a rise in global yields.

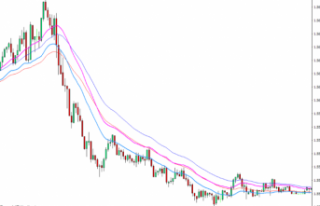

USD/CAD: I have been closely following the post-pandemic slide that the pair has made into the third quarter. I was unable to find a bullish breakout above the descending trend channel, so I looked at the fundamental background. The Fed is moving towards a taper, which will start a hawkish Fed course. However, the BOC has already tapered in April. There is healthy speculation that there will be another taper in the 3Q. This means that the Canadian Dollar has a greater forward yield than the Canadian Dollar, and other fundamental factors on the pair have been largely eliminated. Technically, I'd like to see some progress that could possibly override the Summer Doldrums. A break of 1.2000, which is the middle of the last decade range, could be qualified.

Another well-established market is gold, which is closely tied to the ebbs and flows of monetary policy. The Dollar is the standard base for precious metals, but the commodity is also a reflection on yield and interest rates around the globe. Although the Fed will take time to tighten its reins in the next quarter, the global shift is toward pulling up from an extremely easy path we have seen through the pandemic. It is possible to plot Gold's performance against balances (stimulus), but this also has market roots, with an inverted relationship with the global aggregate of government bond yields. Although this is an underlying view, technical levels will require me to look for a break of 1,675.